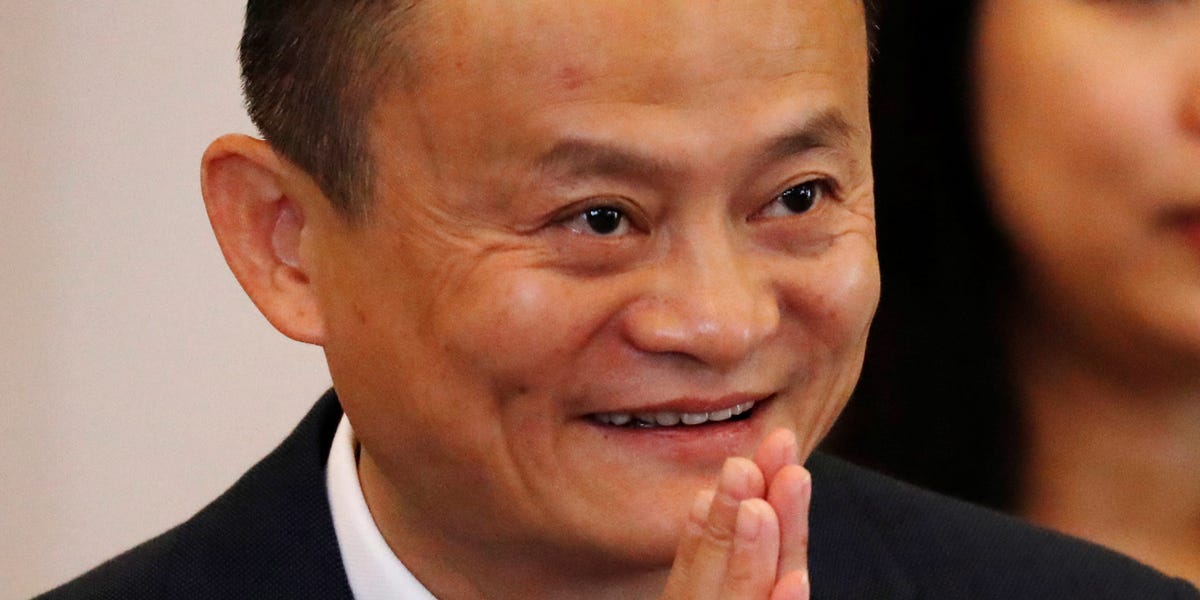

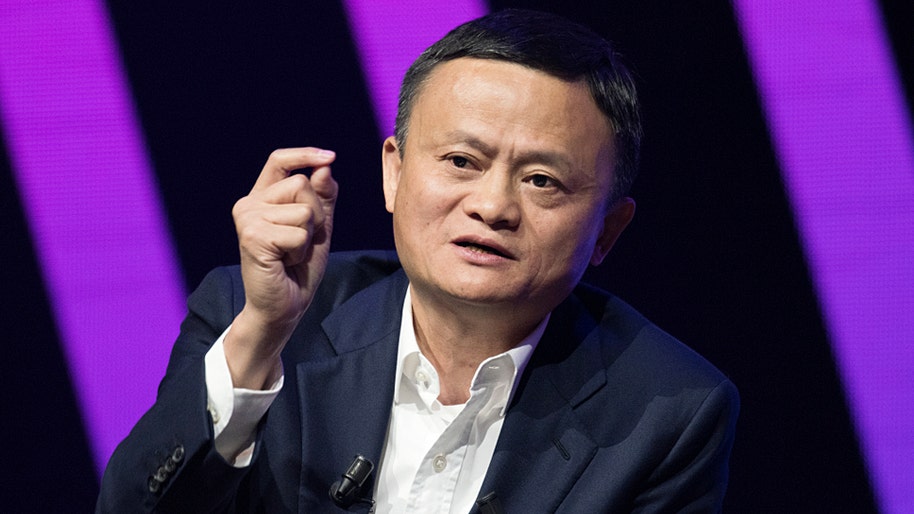

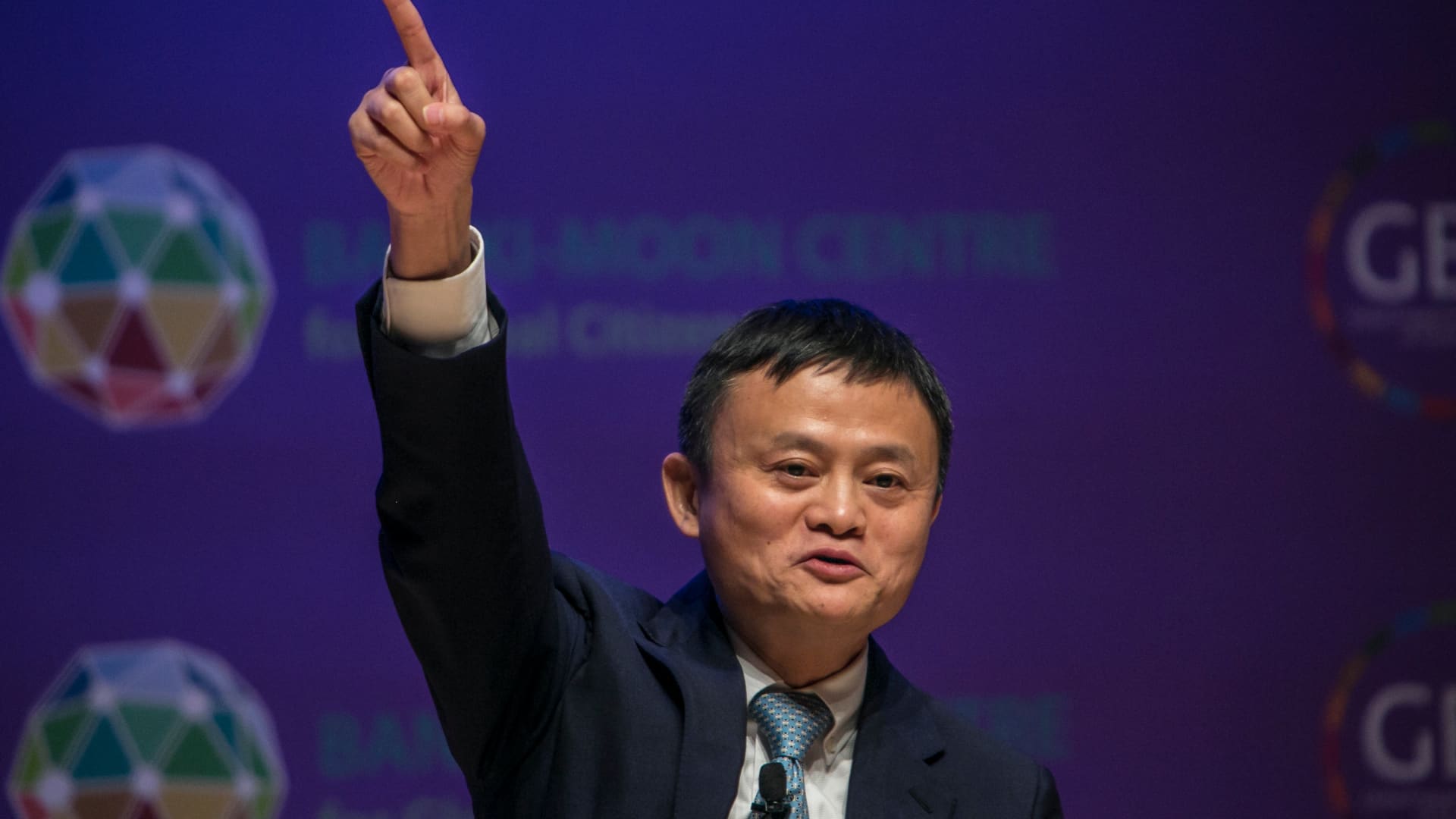

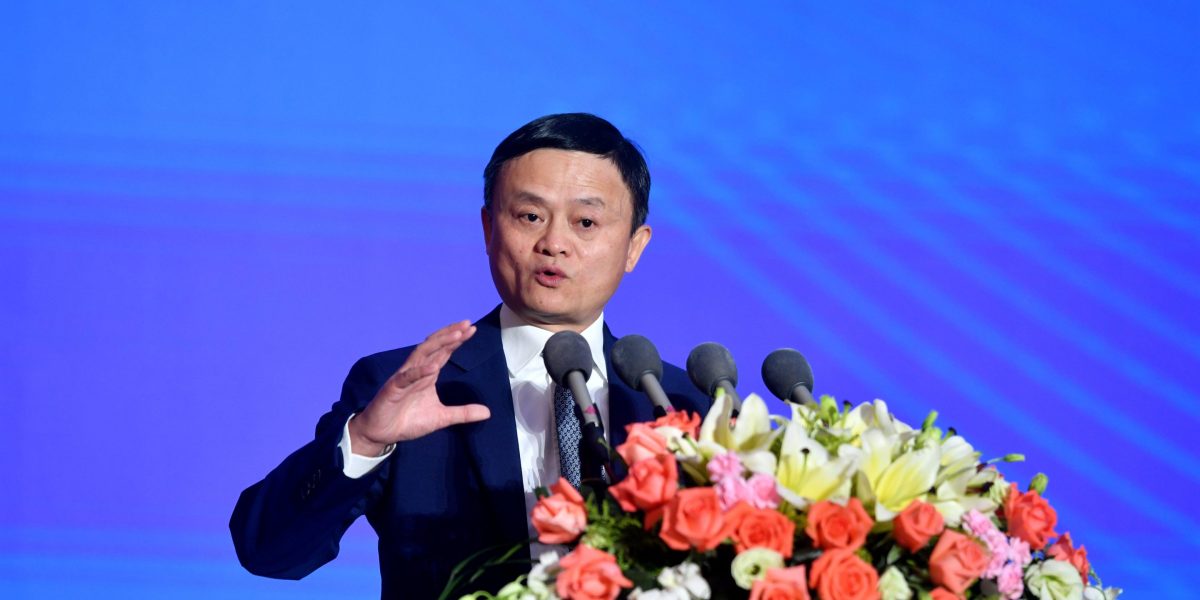

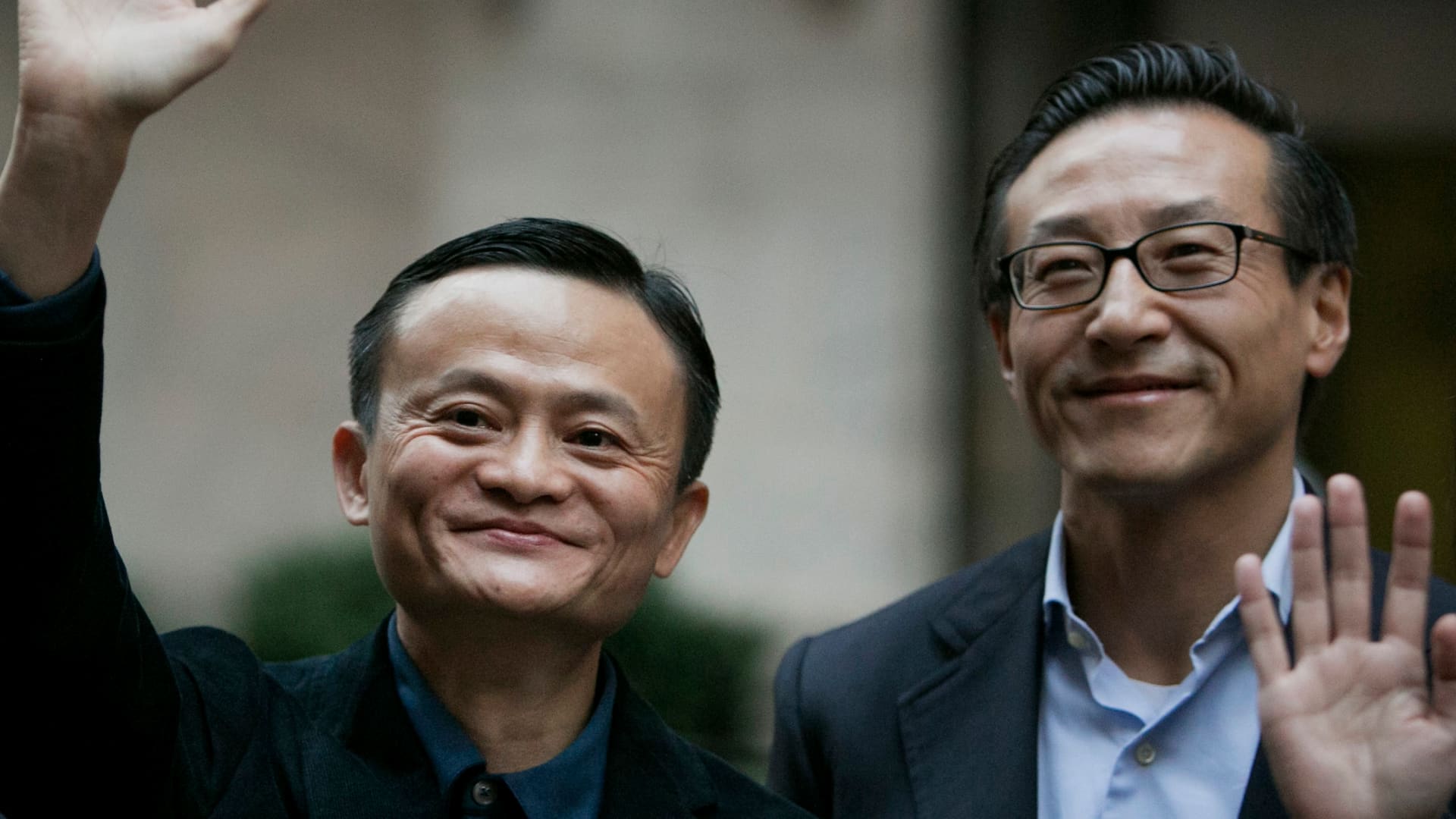

Jack Ma Envisions AI Future in Rare Ant Group Speech

Jack Ma made a rare public appearance at Ant Group's 20th anniversary, emphasizing the future role of artificial intelligence in the fintech company's growth. This marks his return to the spotlight after a government crackdown halted Ant's IPO plans four years ago.