"Apple Faces Multiple Downgrades Amid Persistent iPhone Sales Concerns"

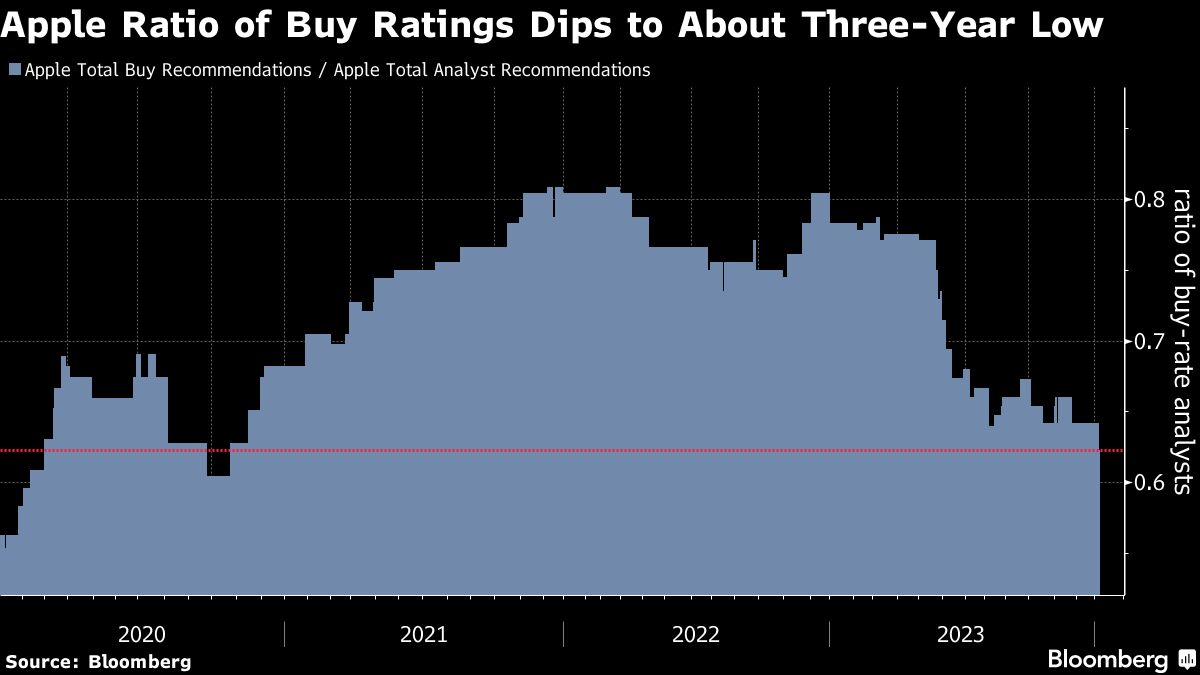

Apple Inc. has faced a second downgrade in a week due to concerns over iPhone sales, particularly in China's weak macro environment. Analyst Harsh Kumar from Piper Sandler downgraded Apple to neutral, while Barclays analysts also turned bearish earlier in the week. Apple's buy-equivalent ratio is at a three-year low, with fewer bullish recommendations compared to other big tech companies. Despite a strong rally last year, Apple's stock has declined early in 2024, with a significant loss in market value. Wall Street's outlook on Apple is cautious, contrasting with the generally bullish sentiment on big tech.