"Apple Faces Multiple Downgrades Amid Persistent iPhone Sales Concerns"

TL;DR Summary

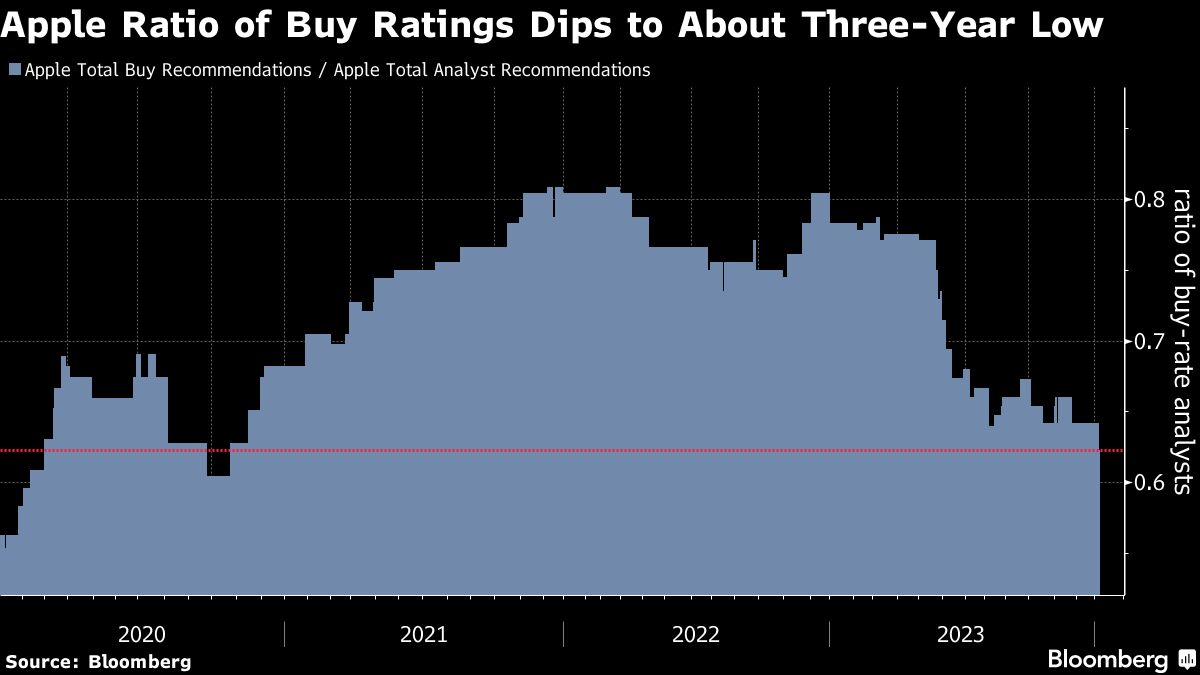

Apple Inc. has faced a second downgrade in a week due to concerns over iPhone sales, particularly in China's weak macro environment. Analyst Harsh Kumar from Piper Sandler downgraded Apple to neutral, while Barclays analysts also turned bearish earlier in the week. Apple's buy-equivalent ratio is at a three-year low, with fewer bullish recommendations compared to other big tech companies. Despite a strong rally last year, Apple's stock has declined early in 2024, with a significant loss in market value. Wall Street's outlook on Apple is cautious, contrasting with the generally bullish sentiment on big tech.

- Apple Hit With Second Downgrade This Week on iPhone Worries Yahoo Finance

- Top stocks to watch on Wall Street Thursday CNBC

- Apple’s stock gets another downgrade as iPhone doldrums could continue MarketWatch

- What's behind Apple's $100 billion market-cap loss today? A major downgrade that has investors worried about slowing iPhone sales is the key culprit Fortune

- Apple Stock Downgraded Again Citing iPhone Sales Concerns Forbes

Reading Insights

Total Reads

0

Unique Readers

9

Time Saved

2 min

vs 3 min read

Condensed

77%

425 → 96 words

Want the full story? Read the original article

Read on Yahoo Finance