Medicare Pay Freeze Roils Health Stocks as Nvidia-Backed Deals Boost Tech and Industrials

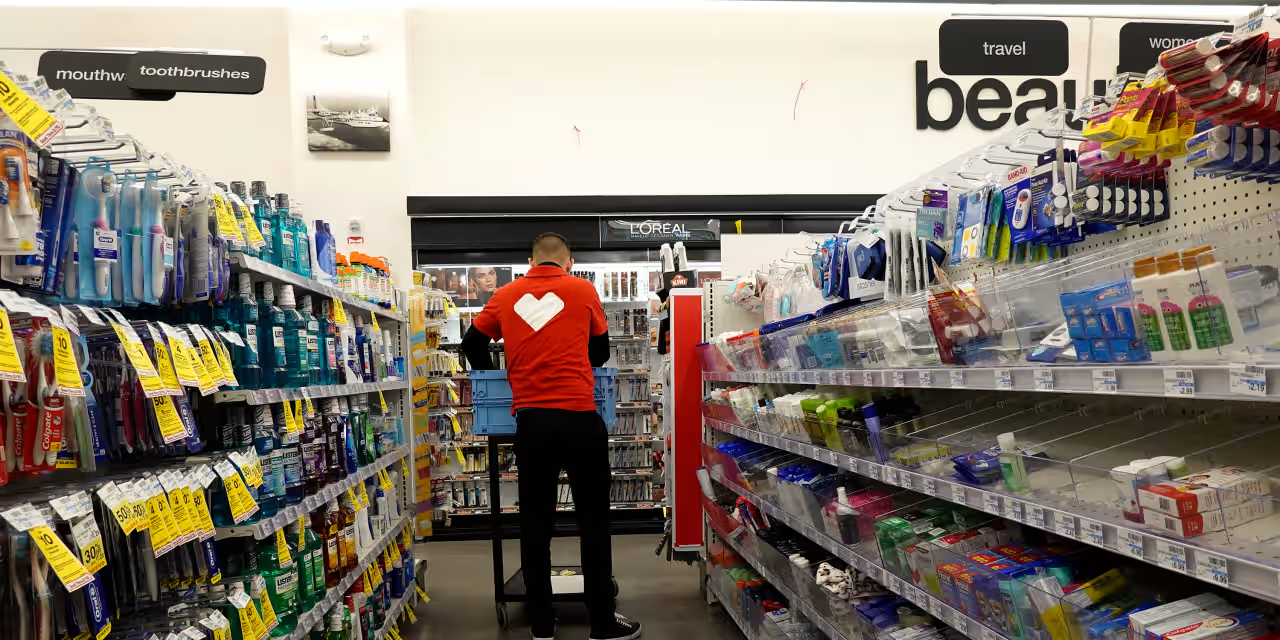

Health-care stocks tumbled after the CMS proposed keeping private Medicare Advantage payments nearly flat for 2027, with UnitedHealth and Humana down about 20%–21% and insurers like CVS/Elevance also lower. Micron rose ~5% on a $24 billion Singapore investment plan. General Motors jumped ~9% after strong earnings and a 20% dividend hike to 18 cents. CoreWeave advanced ~11% on an expanded Nvidia partnership and a $2 billion investment, while Corning rose ~16% on a multiyear Meta data-centers materials deal. Other notable moves included RTX up ~3.7%, Northrop Grumman higher, Boeing down ~1.6%, and airline and steel names among the decliners.