Energy Transfer LP (NYSE:ET) Reports Strong Q4 Earnings and Record EBITDA

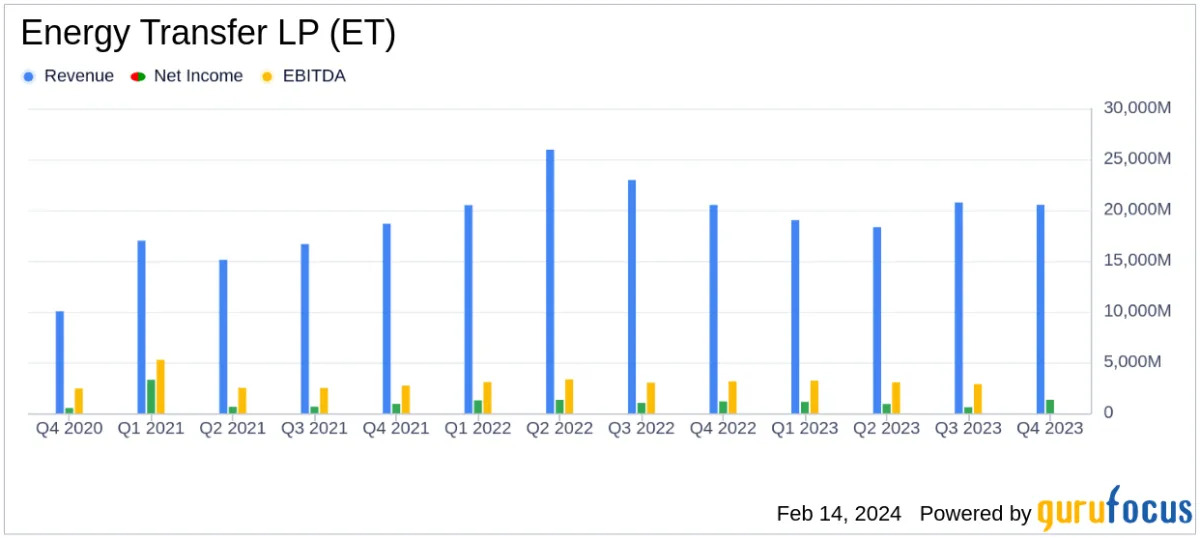

Energy Transfer LP (NYSE:ET) reported a Q4 2023 EPS of $0.37, beating expectations of $0.29, and announced a quarterly cash distribution increase of 3.3%. The company generated adjusted EBITDA of $13.7 billion for the full year 2023, up 5% from 2022, and expects 2024 adjusted EBITDA to be between $14.5 billion and $14.8 billion. Energy Transfer also provided updates on various growth projects, including expansions to NGL export capacity, new pipeline acquisitions, and the Lake Charles LNG project, while addressing ongoing legal matters related to pipeline crossings in Louisiana.