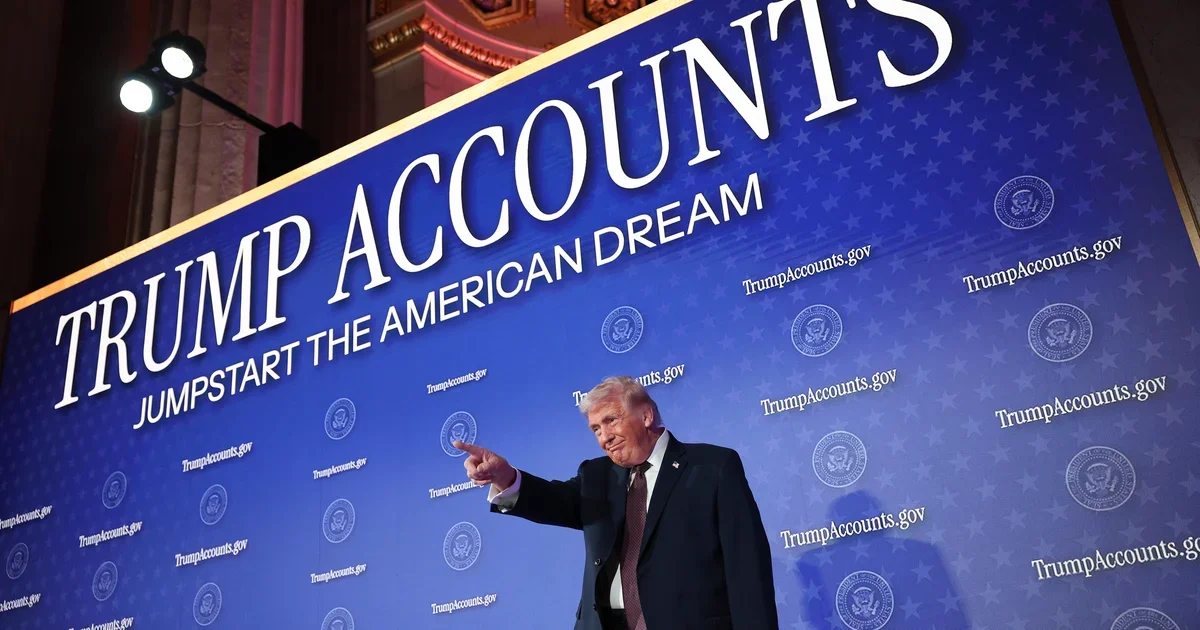

Big Banks Offer $1,000 Match for Trump Accounts for Newborns

Bank of America and JPMorgan Chase will match the government's $1,000 seed for Trump Accounts for eligible newborns born 2025–2028, joining a broader corporate push to support the White House savings plan. Other firms, including Intel and Visa, have pledged support as well. Employers can contribute up to $2,500 per year (counting toward a $5,000 annual limit per child), with employees able to make pre‑tax contributions. The accounts begin July 4, and withdrawals are typically restricted until the child turns 18.