Regulators Lift 2016 Penalty on Wells Fargo

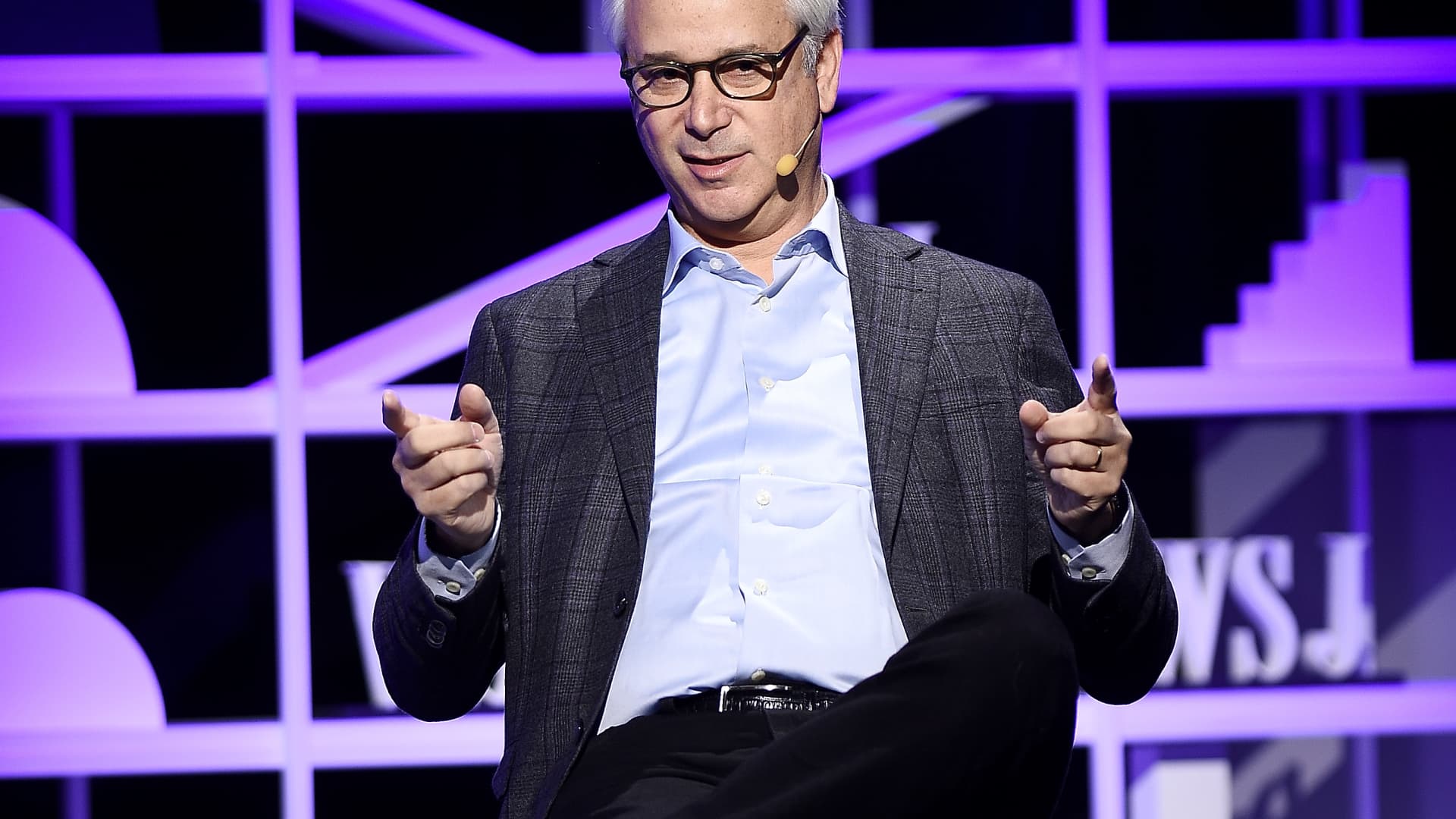

Wells Fargo announced that the U.S. Office of the Comptroller of the Currency has lifted a 2016 punishment related to the bank's sales practices, marking progress in its efforts to address compliance issues stemming from a fake accounts scandal. This is the sixth consent order terminated by regulators since 2019, signaling a positive step for the bank. However, Wells Fargo still operates under an asset cap imposed by the Federal Reserve and has eight remaining open consent orders. The removal of the asset cap would represent a significant turning point for the bank, and CEO Charlie Scharf expressed confidence in the company's trajectory.