"Boeing's Leadership Shake-Up and Stock Impact"

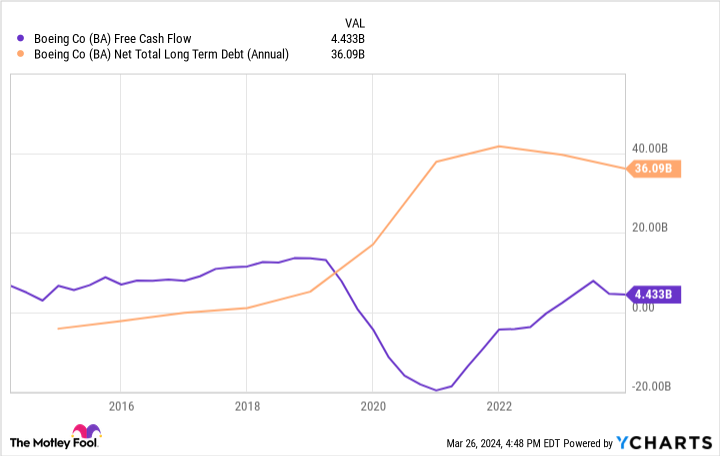

Boeing announced a major executive shakeup with the departure of its CEO, chair of the board, and head of commercial airplanes, signaling a significant change in leadership. The company's new leadership team includes Steve Mollenkopf as the new chair of the board and Stephanie Pope as the head of the commercial airline division. The company's ability to increase production and improve quality control will be crucial for its cash flow and stock performance, with potential for significant profit growth if these issues are resolved.