Unveiling the Prospects and Pitfalls of Wall Street's $1 Trillion Climate Market

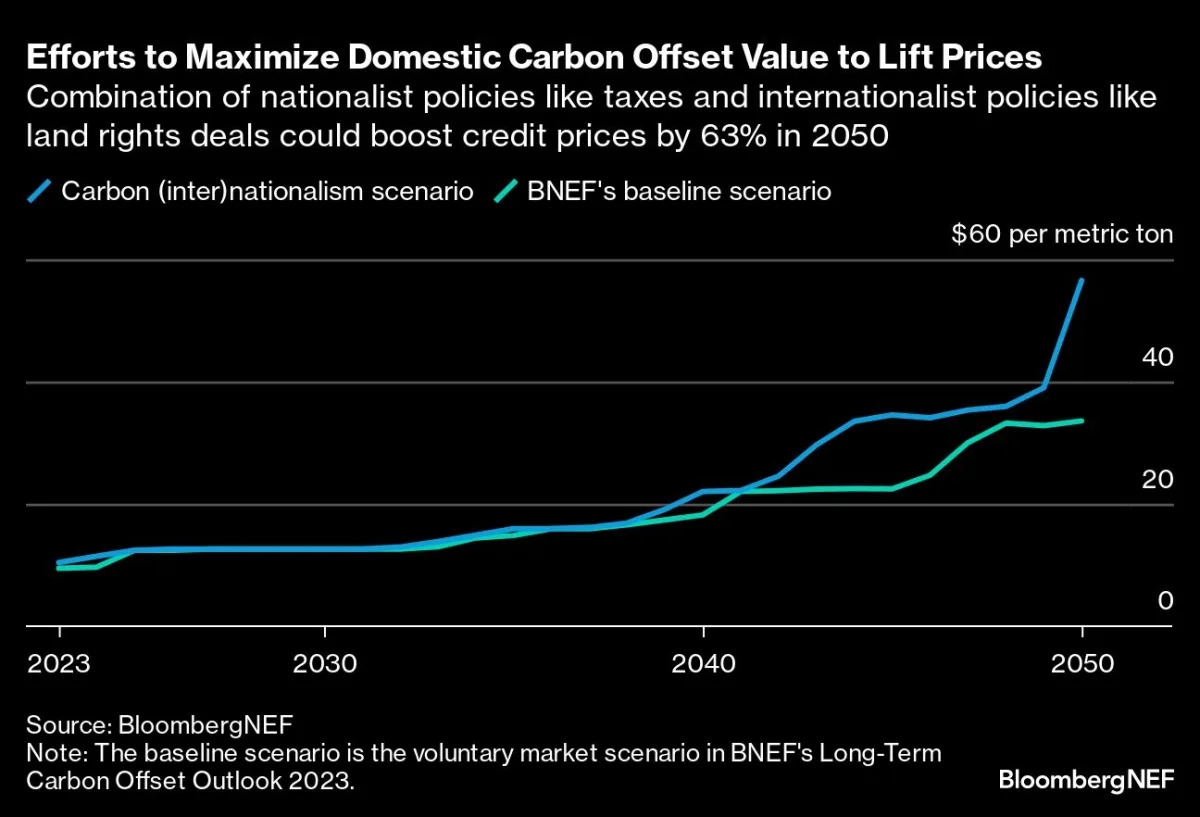

Wall Street and City of London banks, including Goldman Sachs, Citigroup, JPMorgan Chase, and Barclays, are positioning themselves to capitalize on the growing carbon offset market, which has the potential to reach $1 trillion. These banks are looking to finance carbon sequestration projects, trade credits, and advise corporate clients on buying offsets. They also aim to support local projects in emerging markets that lack financial resources. However, the market still faces controversies and criticism for the failure of some credits to live up to environmental claims. Despite this, banks are eager to enter the market and balance speed with a deep understanding of evolving norms and expectations. The arrival of global banks in an unregulated market raises concerns for some, but efforts are being made to improve transparency and establish integrity frameworks. Carbon prices are currently low, but demand is expected to increase as companies seek to meet net zero goals.