Bitcoin ETFs Surge Amidst Establishment Influence and Record Holdings

TL;DR Summary

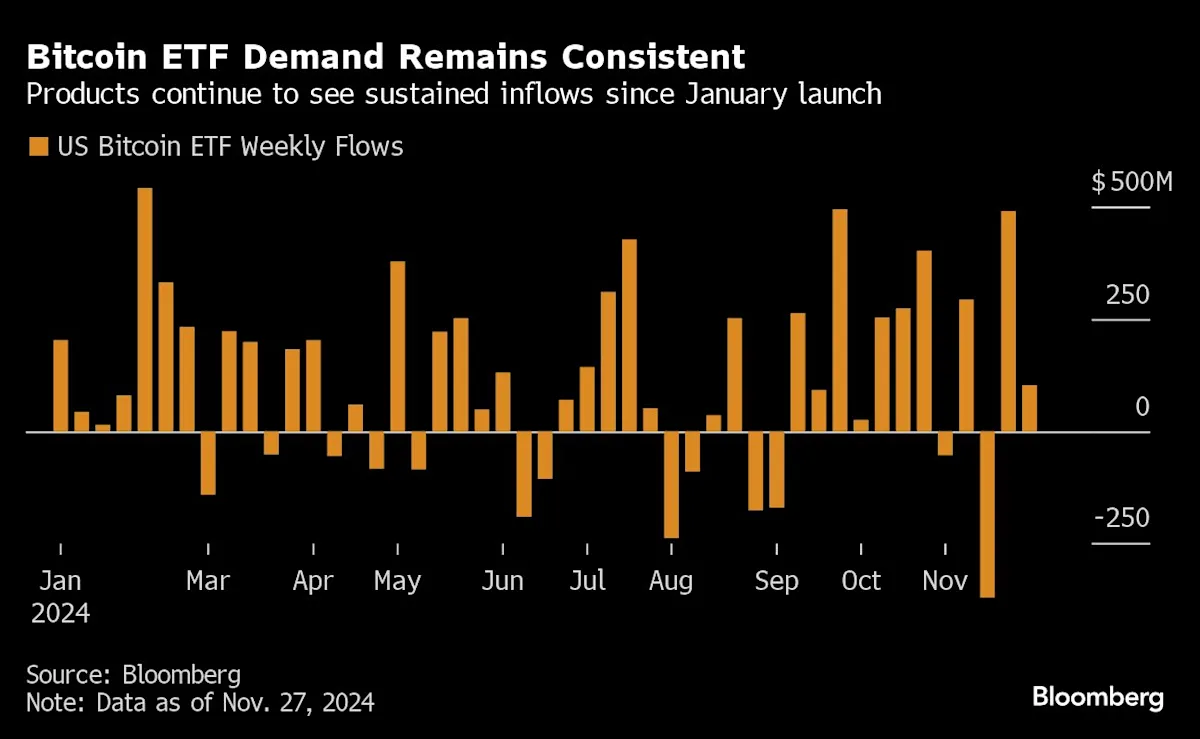

Bitcoin's increasing adoption by establishment institutions, including the potential for a US government stockpile, is raising concerns about concentration risk. With over 1 million Bitcoins held by US exchange-traded funds and significant holdings by companies like MicroStrategy, the cryptocurrency's landscape is shifting from its libertarian roots. Despite these changes, the demand continues to drive prices up, and the decentralized nature of Bitcoin's blockchain prevents any single entity from controlling its operations.

- The Establishment Takeover of Bitcoin Creates New List of Risks Yahoo Finance

- Crypto: The Establishment Takeover of Bitcoin Creates New List of Risks Bloomberg

- Bitcoin ETFs Reel in $103M in a Day, Pushing Cumulative Inflows to $30.38B – Finance Bitcoin News Bitcoin.com News

- Data: In November, the US spot Bitcoin ETF purchased about 71,570 BTC, while mining output in the same period was only about 13,500 PANews

- Global Bitcoin ETFs Reach Record Holdings of 1.26 Million BTC Worth $123 Billion Binance

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

84%

438 → 71 words

Want the full story? Read the original article

Read on Yahoo Finance