Navigating Recession: Insights from Experts.

TL;DR Summary

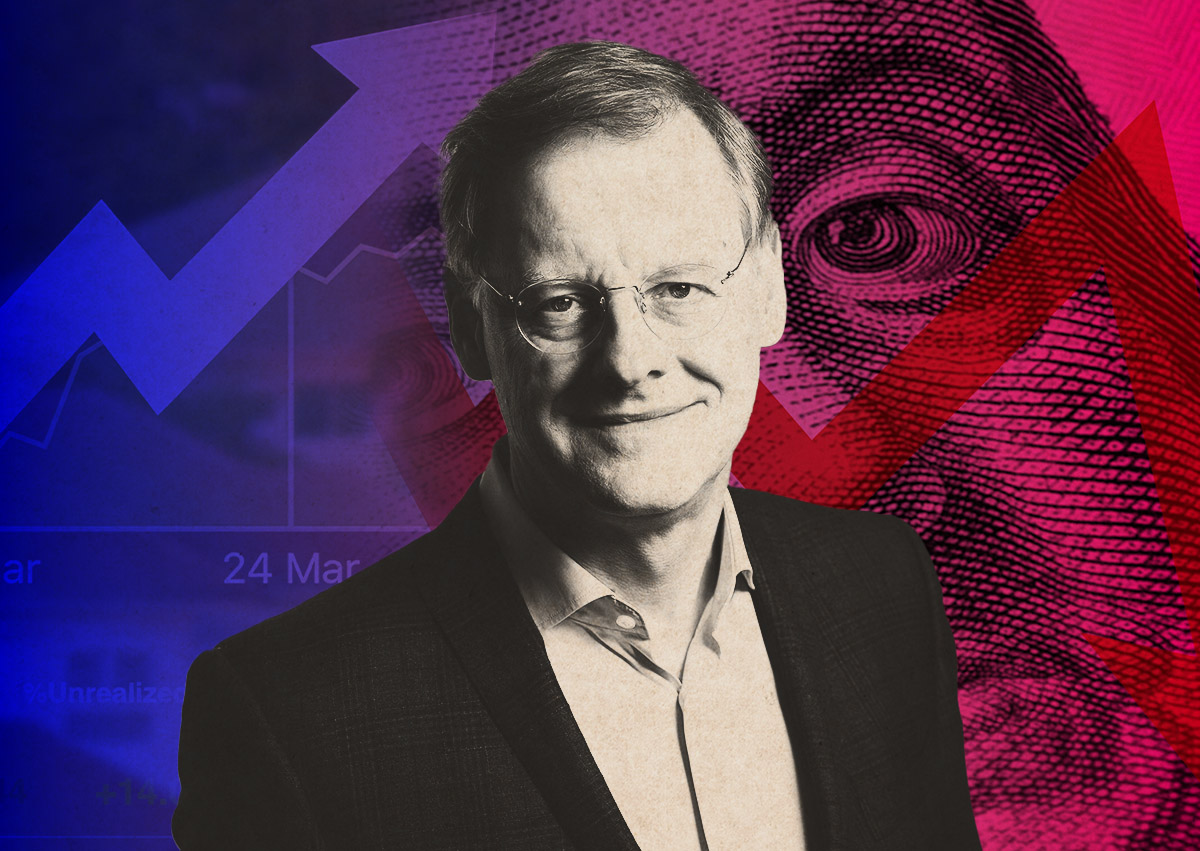

CBRE's chief global economist Richard Barkham predicts a mild recession in 2023, but long-term factors like an "economic revival" in 2024 will benefit commercial and residential real estate. However, real estate values will decrease during the recession, with office values potentially falling by more than a third. Multifamily housing is oversupplied, which could freeze rent increases in certain markets. Despite this, values should rebound "relatively quickly" compared to other slumps, with industrial taking two years, multifamily three years, and retail four years. Offices could take nine years to recover their values.

- CBRE: Recession to Tank CRE Values in 2023 Before Revival The Real Deal

- Deep Value Stocks Are Super Cheap. Why a Recession Isn't a Worry. Barron's

- Billionaire Investing Expert Suggests Where To Point Your Money During 'Non-Recession' Recession -- 3 Key Takeaways GOBankingRates

- Economists reversing course on recession fears CBS News

- Kelly Evans: This is all pretty textbook. CNBC

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

2 min

vs 3 min read

Condensed

83%

533 → 91 words

Want the full story? Read the original article

Read on The Real Deal