VIX Reaches 3-Year Low, Indicating Market Stability.

TL;DR Summary

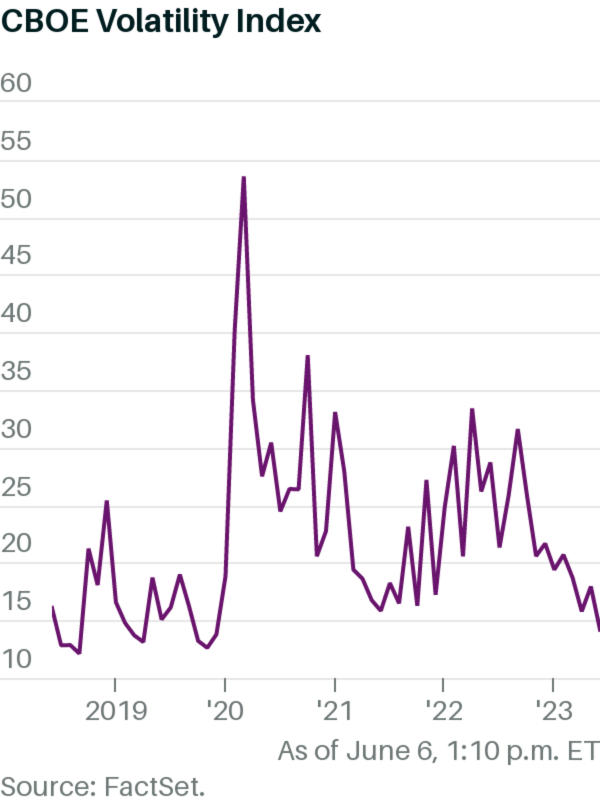

The VIX, a measure of market volatility, is approaching its early 2020 low, indicating that market sentiment is becoming more optimistic. This could be due to a variety of factors, including positive economic data and the easing of pandemic-related restrictions. However, some analysts caution that the low VIX could also be a sign of complacency among investors, and that a sudden shift in market conditions could lead to increased volatility.

- The VIX Is Flirting With Its Early 2020 Low. What It Means. Barron's

- Yellow Flags Appear for the Market as VIX Hits a 3-Year Low RealMoney

- Wall Street's New Fear Gauge Is Trading in Curiously Stable Way Bloomberg

- Market volatility eases as VIX drops to lowest level since Jan. 2020 Seeking Alpha

- Wall Street's 'Fear Gauge' at 3-Year Lows as S&P 500 Nears Bull Market TheStreet

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

0 min

vs 1 min read

Condensed

-169%

26 → 70 words

Want the full story? Read the original article

Read on Barron's