Venture Firms Pivot to Smaller Funds in Strategic Shift

TL;DR Summary

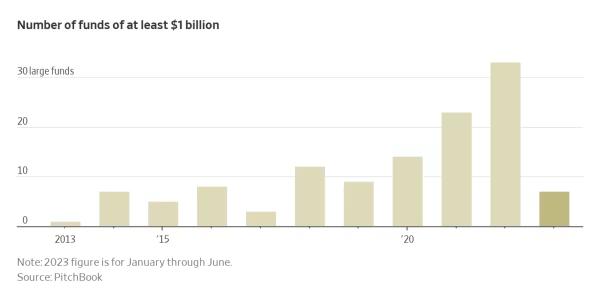

Venture firms are scaling back on megafunds, as they reduce the size of their investment vehicles amid concerns of overvaluation and increased competition. This shift reflects a more cautious approach to fundraising, with firms focusing on smaller, more targeted funds to maintain flexibility and generate better returns. The move also comes as investors become more discerning, seeking out firms with proven track records and specialized expertise in specific sectors.

Venture Firms Scale Back Megafunds in Strategy Shift - WSJ The Wall Street JournalView Full Coverage on Google News

Reading Insights

Total Reads

0

Unique Readers

5

Time Saved

0 min

vs 1 min read

Condensed

-30%

53 → 69 words

Want the full story? Read the original article

Read on The Wall Street Journal