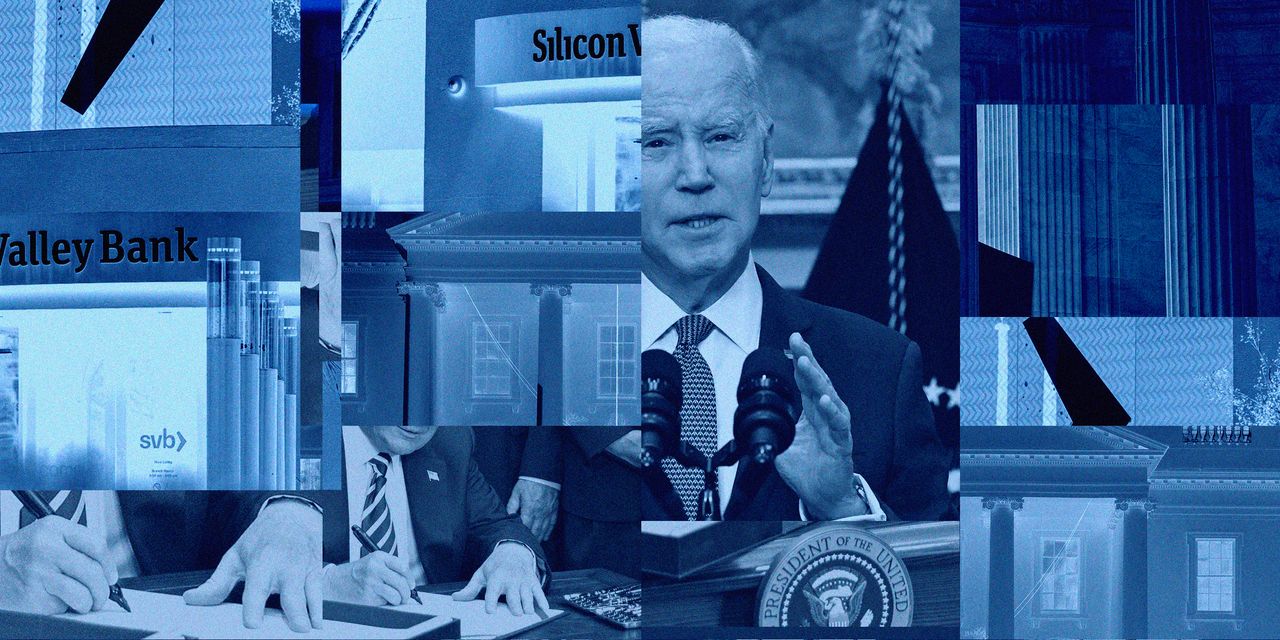

The Risk of Small Banks: Lessons from SVB's Collapse.

TL;DR Summary

The collapse of SVB, a small bank in the US, highlights the potential risk posed by smaller banks in large numbers. While smaller banks may not individually pose a significant risk, their collective impact can be significant. This underscores the importance of effective regulation and oversight of the banking industry.

- SVB Collapse Shows Smaller Banks Can Pose Risk in Numbers The Wall Street Journal

- Silicon Valley Bank left a void that won't easily be filled CNN

- Silicon Valley Bank losses embolden calls for accounting rule reform Financial Times

- Opinion | After Silicon Valley Bank failure, American start-ups still need a bank The Washington Post

- SVB's sudden collapse wasn't a social media triggered 'Twitter run.' It's what people always do when their money is threatened. MarketWatch

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

0 min

vs 1 min read

Condensed

6%

53 → 50 words

Want the full story? Read the original article

Read on The Wall Street Journal