"Spot Bitcoin ETFs: Navigating Hype, Due Diligence, and Approval Timelines"

TL;DR Summary

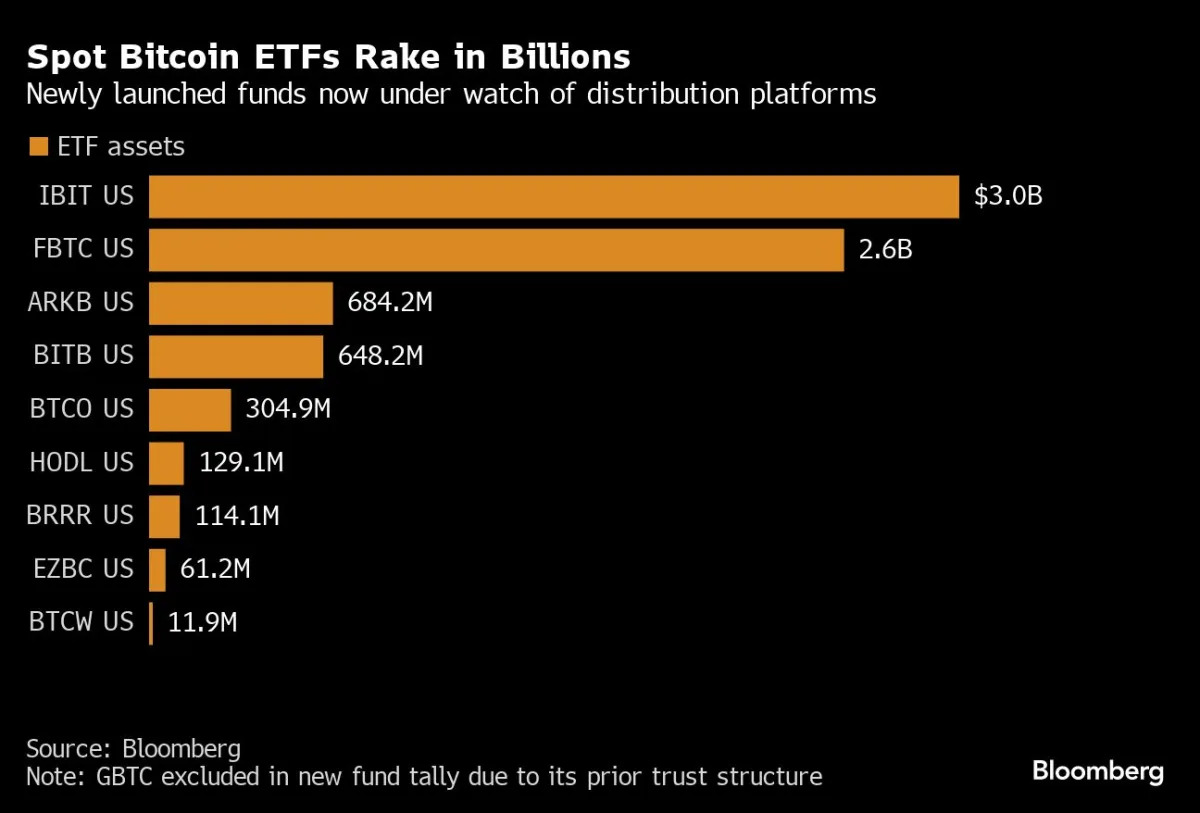

LPL Financial, a gatekeeper of over $1.4 trillion in assets, is cautious about adding new spot-Bitcoin exchange-traded funds (ETFs) to its platform, citing concerns about ETF closures and the need for a strong investment thesis. The company's head of wealth-management solutions, Rob Pettman, emphasized the importance of assessing how the new funds perform in the markets over the next three months before deciding which ones to offer to clients. With the recent approval of Bitcoin ETFs, the industry is closely monitoring their asset accumulation and trading performance, as well as the potential for closures if they fail to attract significant assets.

- LPL's $1.4 Trillion Gatekeeper Avoids Bitcoin-ETF Hype, for Now Yahoo Finance

- A Bitcoin ETF Will Never Be Your Bitcoin CoinDesk

- Bitcoin ETFs hype stalled by due diligence — Bloomberg Cointelegraph

- Spot Bitcoin ETFs rank among largest commodity ETFs by assets held CryptoSlate

- It took a decade for spot Bitcoin ETFs to be approved. How much longer for options? Fortune

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

3 min

vs 4 min read

Condensed

87%

797 → 101 words

Want the full story? Read the original article

Read on Yahoo Finance