"Nvidia's Stock Valuation and Investor Sentiment: What to Watch in 2024"

TL;DR Summary

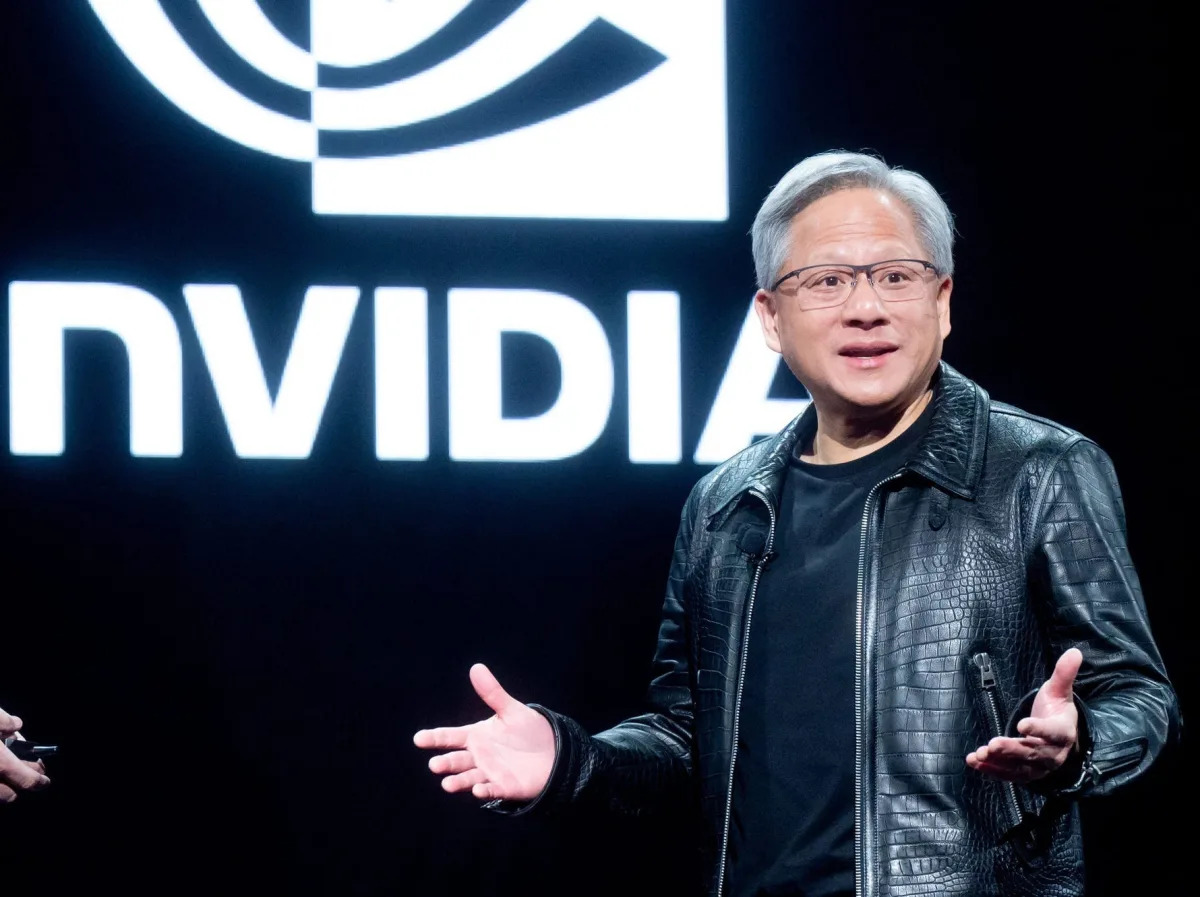

Bank of America increased its price target for Nvidia to $1,100, citing a lower forward P/E ratio compared to November 2022 and suggesting a 24% potential upside even at a $2 trillion valuation. Despite the stock's 80% YTD surge, it is still trading at lower valuations than in 2022, and ownership levels indicate room for further upside. The upcoming "AI Woodstock" event on March 18 could provide additional momentum, as Nvidia is set to unveil the successor to its H100 chip and showcase the impact of genAI and digital twins across various markets.

- Nvidia stock still isn't expensive even at a $2 trillion valuation, BofA says Yahoo Finance

- Analyst adjusts stock price target for Nvidia ahead of conference Yahoo Finance

- What to Expect From NVIDIA GTC 2024 Spiceworks News and Insights

- Sell Nvidia or stick with it? Here's what investors say CNBC

- Why Nvidia share price is plummeting after 80% rally in YTD — explained Mint

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

1 min

vs 2 min read

Condensed

75%

365 → 93 words

Want the full story? Read the original article

Read on Yahoo Finance