Navigating the S&P 500: Strategies for Volatile Markets

TL;DR Summary

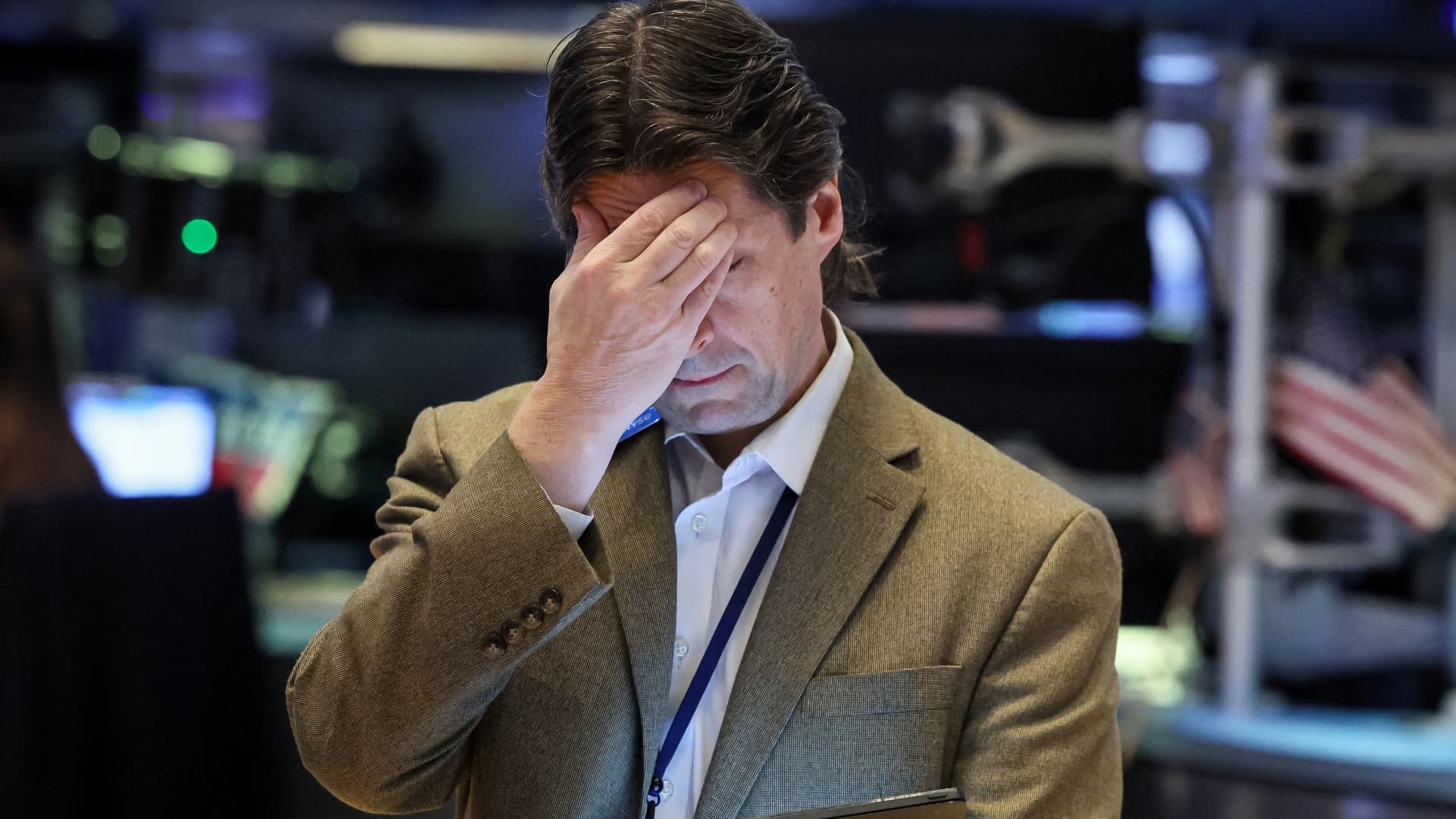

The S&P 500 is currently at a critical point, prompting investors to consider protective measures for their portfolios. With market volatility on the rise, experts recommend diversifying investments, considering defensive sectors, and utilizing options strategies to hedge against potential downturns. Additionally, staying informed about market trends and maintaining a long-term perspective are crucial for navigating uncertain market conditions.

Topics:business#finance#investment-strategies#market-analysis#portfolio-protection#sandp-500#stock-market

- The charts show the S&P 500 is at a very critical juncture. How to protect your portfolio CNBC

- S&P 500 earnings: Can stocks rally beyond Magnificent Seven? Yahoo Finance

- Stock Market News: Dow Heads Higher Barron's

- Markets News, Feb. 12, 2024: Stock Rally Loses Steam; Bitcoin Tops $50K Investopedia

- Stocks Settle Mixed Ahead of Tuesday's U.S. CPI Report Nasdaq

Reading Insights

Total Reads

0

Unique Readers

5

Time Saved

0 min

vs 1 min read

Condensed

-729%

7 → 58 words

Want the full story? Read the original article

Read on CNBC