MicroStrategy Raises $1.75B to Boost Bitcoin Investments

TL;DR Summary

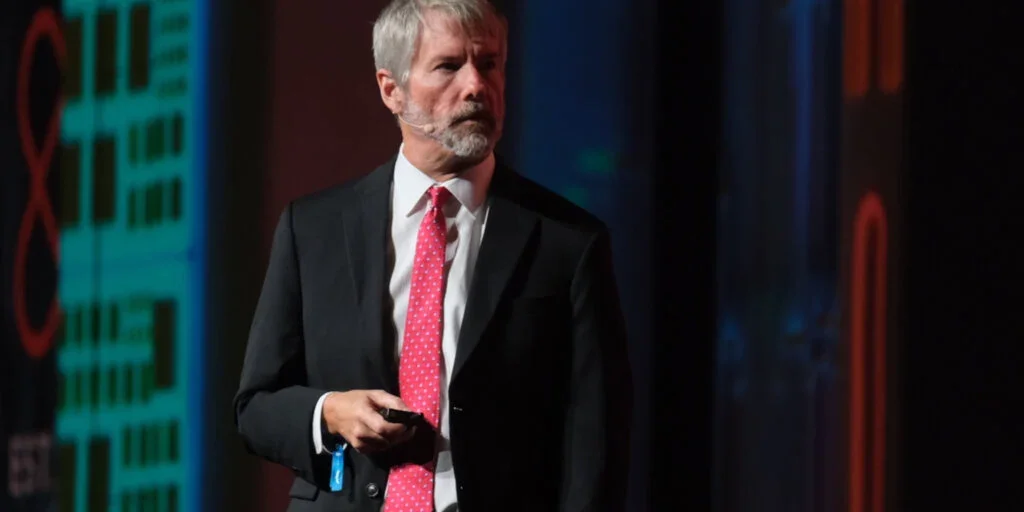

MicroStrategy plans to raise $1.75 billion through convertible notes to expand its Bitcoin holdings, aiming to acquire up to 19,000 additional BTC. The company, led by Michael Saylor, recently purchased $4.6 billion worth of Bitcoin, bringing its total to 331,200 BTC, now valued at over $30 billion. The notes, maturing in 2029, will be offered to institutional buyers and can be converted into cash or stock. MicroStrategy's aggressive Bitcoin strategy has significantly boosted its market capitalization and stock value.

Topics:business#bitcoin#convertible-notes#finance#institutional-investment#michael-saylor#microstrategy

- MicroStrategy Plans $1.75 Billion Convertible Notes Offering to Expand Bitcoin Holdings Decrypt

- Watch These MicroStrategy Levels as Stock Soars to Record High After Bitcoin Purchase Investopedia

- Bitcoin Buyer Spree: MicroStrategy Acquires $4.6B In BTC, Metaplanet Issues $11.4M In Bonds To Fund Purchases Benzinga

- MicroStrategy to Sell $1.75 Billion of Convertible Debt to Buy More Bitcoin Barron's

- MicroStrategy Announces Proposed Private Offering of $1.75 Billion of Convertible Senior Notes Business Wire

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

86%

564 → 79 words

Want the full story? Read the original article

Read on Decrypt