"Maximizing Returns: Strategies for Choosing CD Terms and Rates in 2024"

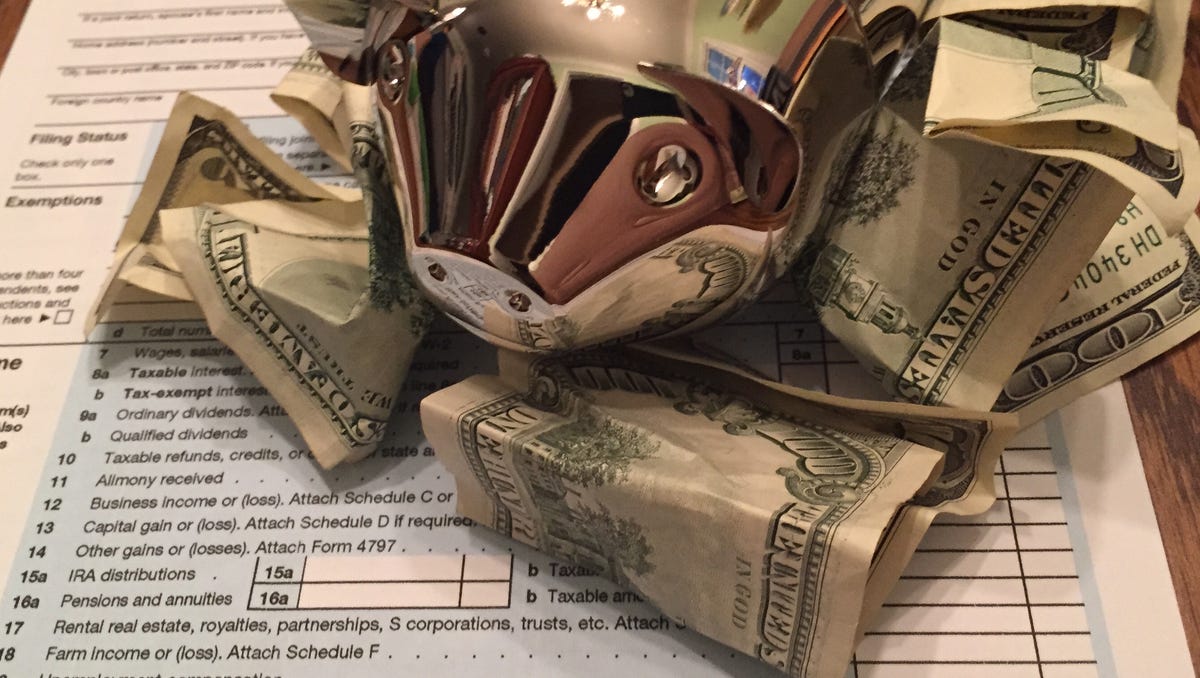

In 2023, savers enjoyed high CD rates, with some securing interest rates around 5% or higher, the highest in 15 years. However, as tax season approaches, they must prepare for the tax implications of their earned interest. Interest from CDs and high-yield savings accounts is taxable and must be reported on 2023 federal income tax returns. Financial institutions will issue a 1099-INT form for interest earned, which is taxable even if the CD has not been cashed, except for U.S. savings bonds and tax-deferred accounts like IRAs. With the Federal Reserve's rate hikes in 2023, interest rates increased significantly, but the Fed is expected to cut rates in 2024 as inflation drops. Savers need to be aware of potential tax liabilities from their higher interest earnings during the upcoming tax season.

- Paying taxes on CD interest? 1099-INT forms coming by Jan. 31 Detroit Free Press

- Now May Be the Time to Lock In High Interest Rates on Your Savings The New York Times

- Long-term CDs vs. short-term CDs: Which will be better in 2024? CBS News

- Best CD rates of January 2024 (up to 6.5%) MarketWatch

- Find the highest CD rates for January 3, 2024 CNN Underscored

Reading Insights

0

6

6 min

vs 7 min read

90%

1,360 → 131 words

Want the full story? Read the original article

Read on Detroit Free Press