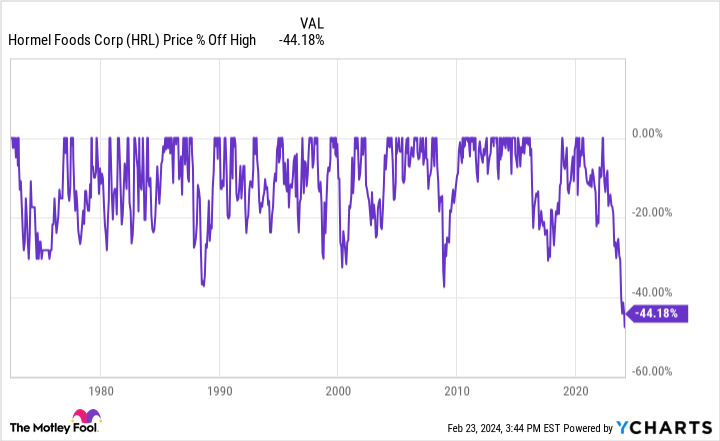

"Is the Greatest Dividend Stock a Buy Again After a 45% Drop?"

TL;DR Summary

Hormel Foods, a consistent dividend payer with a history of increasing dividends for over 50 years, has seen its stock price drop by about 45%, leading to a significantly cheaper valuation. The company's focus on foodservice sales, particularly in convenience stores, presents a potential for future growth and higher-margin revenue. With the stock trading at a compelling valuation, now may be an opportune time to consider investing in Hormel.

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

4 min

vs 4 min read

Condensed

91%

775 → 69 words

Want the full story? Read the original article

Read on Yahoo Finance