Icahn Enterprises' Market Cap at Risk as Wealth Plunges on Short Report.

TL;DR Summary

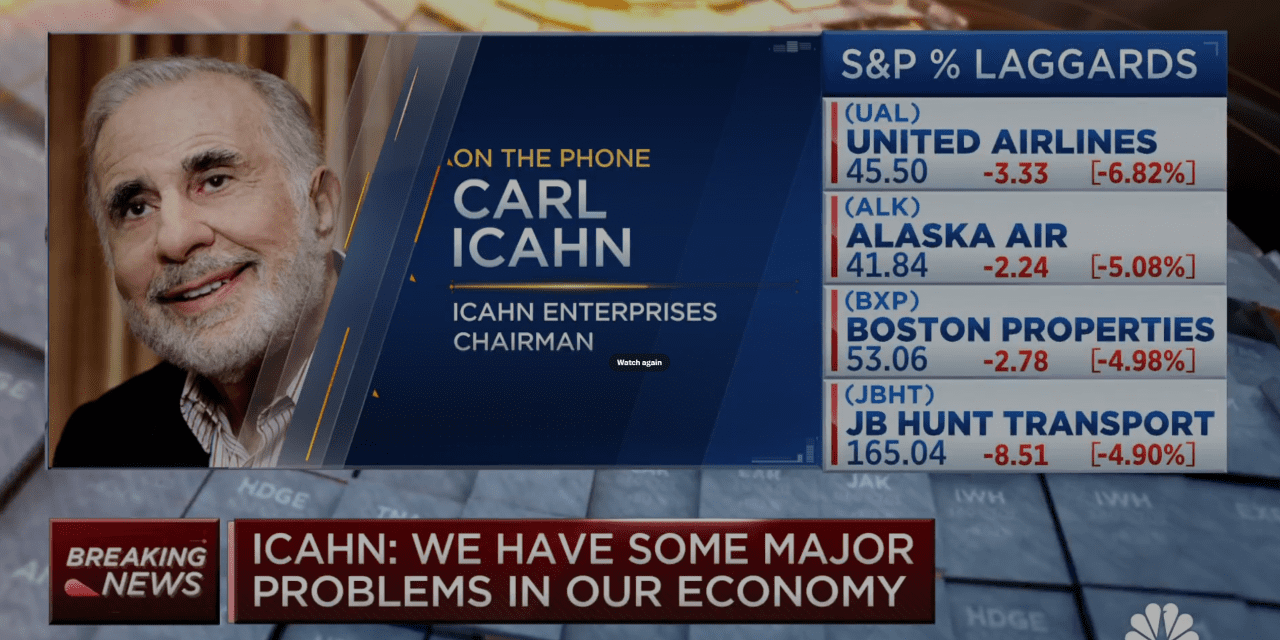

Icahn Enterprises, the investment arm of activist investor Carl Icahn, saw its stock slide another 20% on Wednesday, following a 20% decline on Tuesday, after short seller Hindenburg Research accused the company of inflating its value. The two-day slide has cost the company about $6.6 billion in market cap.

- Icahn Enterprises’ stock slides another 20% to put additional $2.6 billion of market cap at risk MarketWatch

- Carl Icahn’s Wealth Plunges $10 Billion on Hindenburg Short-Seller Report Yahoo Finance

- Icahn's Wealth Plunges $10 Billion on Short Report Bloomberg Television

- Short investor Hindenburg erases fifth of Icahn empire's value Reuters

- Icahn Enterprises: How Good Is This 25% Yield? (NASDAQ:IEP) Seeking Alpha

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

0 min

vs 1 min read

Condensed

61%

126 → 49 words

Want the full story? Read the original article

Read on MarketWatch