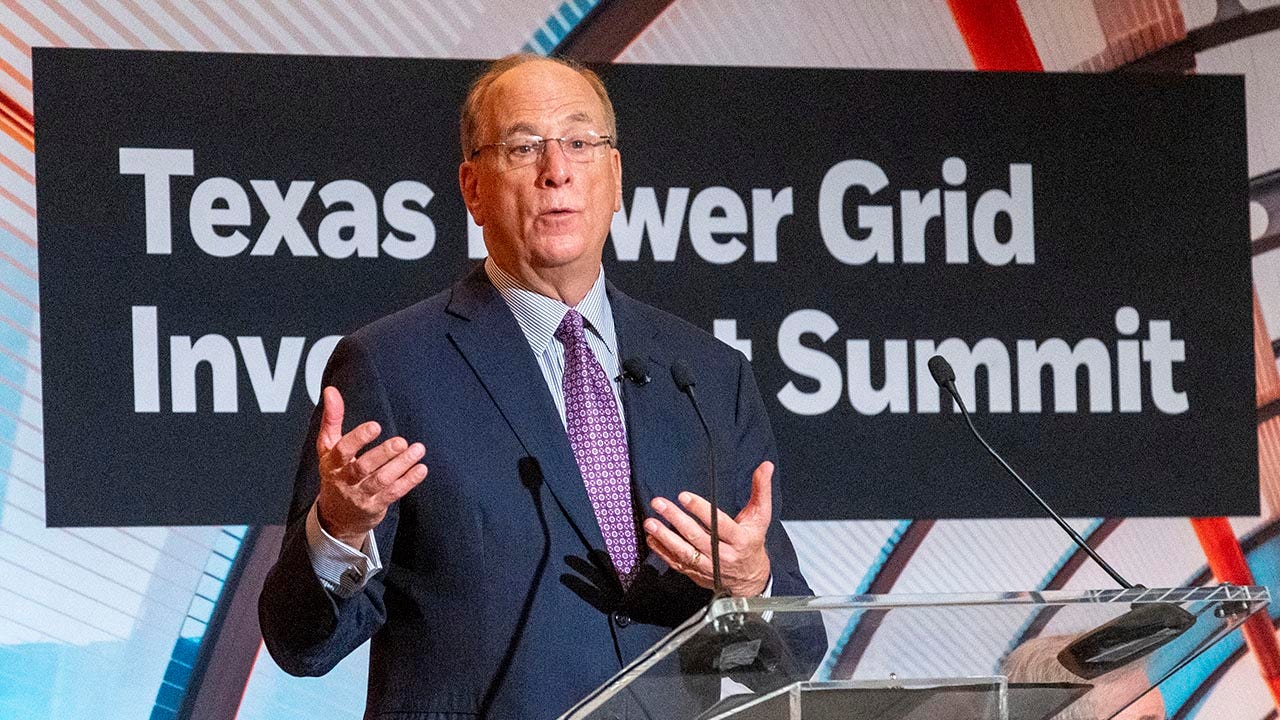

"BlackRock's ESG Advocacy Poses Bottom Line Risk, Admits CEO"

TL;DR Summary

BlackRock acknowledged in its SEC filing that CEO Larry Fink's advocacy for environmental, social, and governance (ESG) policies could harm its reputation and business, facing negative publicity and potential client redemptions. Fink's clean energy advocacy has drawn scrutiny from conservatives, leading to legal actions and blacklisting in some states. The controversy over ESG has also affected other companies, with Bank of America appearing to backtrack on its pledge to not fund new coal projects, and some states passing laws to prevent banks from refusing to finance coal projects.

- BlackRock says ESG advocacy is a risk factor for its bottom line Fox Business

- BlackRock admits CEO Larry Fink's 'woke' ESG activism focus could 'materially adversely' hit business New York Post

- BlackRock Warns Shareholders That ESG Scrutiny Could Harm Its Reputation and Business The Wall Street Journal

- EXCLUSIVE: Republican Officials Demand Answers On BlackRock's 'Woke' Climate Agenda The Daily Wire

- BlackRock Admits Its Bottom Line Could Be Hurt By ESG Investing The Daily Wire

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

85%

570 → 88 words

Want the full story? Read the original article

Read on Fox Business