"Berkshire Hathaway's Record Profits and Buffett's 2024 Shareholder Letter"

Warren Buffett stated that Berkshire Hathaway's sheer size limits its ability to find significant buying opportunities, leading to only slightly better performance than the average American company. With a record $167.6 billion in cash, the conglomerate's recent acquisitions, including a 28% stake in Occidental Petroleum and a 9% stake in Japanese trading companies, fell short of the "elephant-sized" targets Buffett has sought. Despite reaching consecutive record highs and a market value above $900 billion, Buffett believes that Berkshire's diversified businesses should provide only slightly better performance than the average U.S. company, with anything beyond that being wishful thinking.

- Warren Buffett says Berkshire may only do slightly better than the average company due to its sheer size CNBC

- Buffett's Berkshire Posts Record Cash as Operating Earnings Rise Bloomberg

- Read Warren Buffett's 2024 annual letter to shareholders CNBC

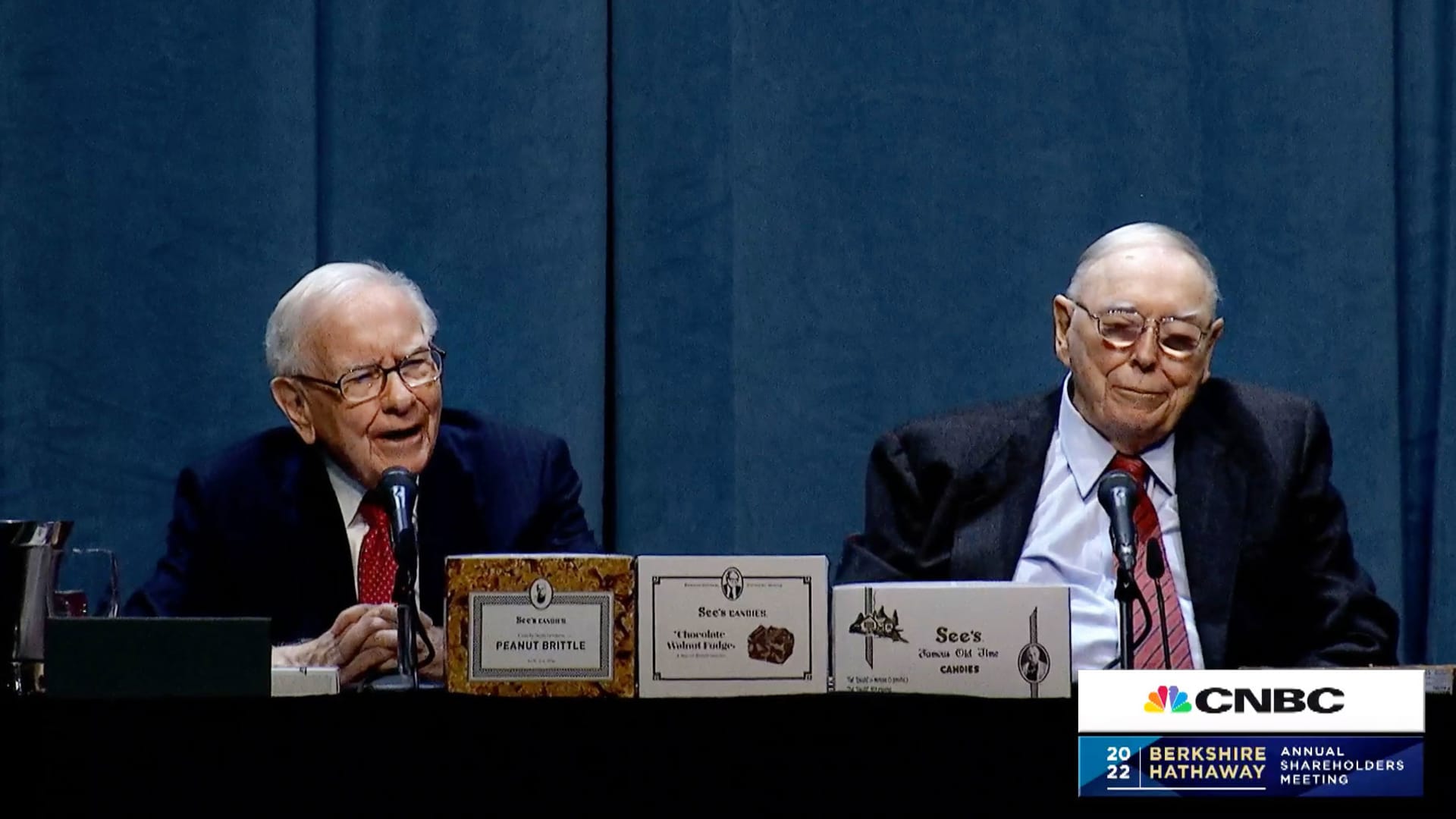

- Warren Buffett: Charlie Munger was the 'architect' of the modern Berkshire Hathaway Yahoo Finance

- Berkshire Hathaway Reports Profit of $97 Billion Last Year, a Record The New York Times

Reading Insights

0

2

1 min

vs 2 min read

74%

379 → 98 words

Want the full story? Read the original article

Read on CNBC