"S&P 500 Bull Run Hits Decade-High Valuation Barrier"

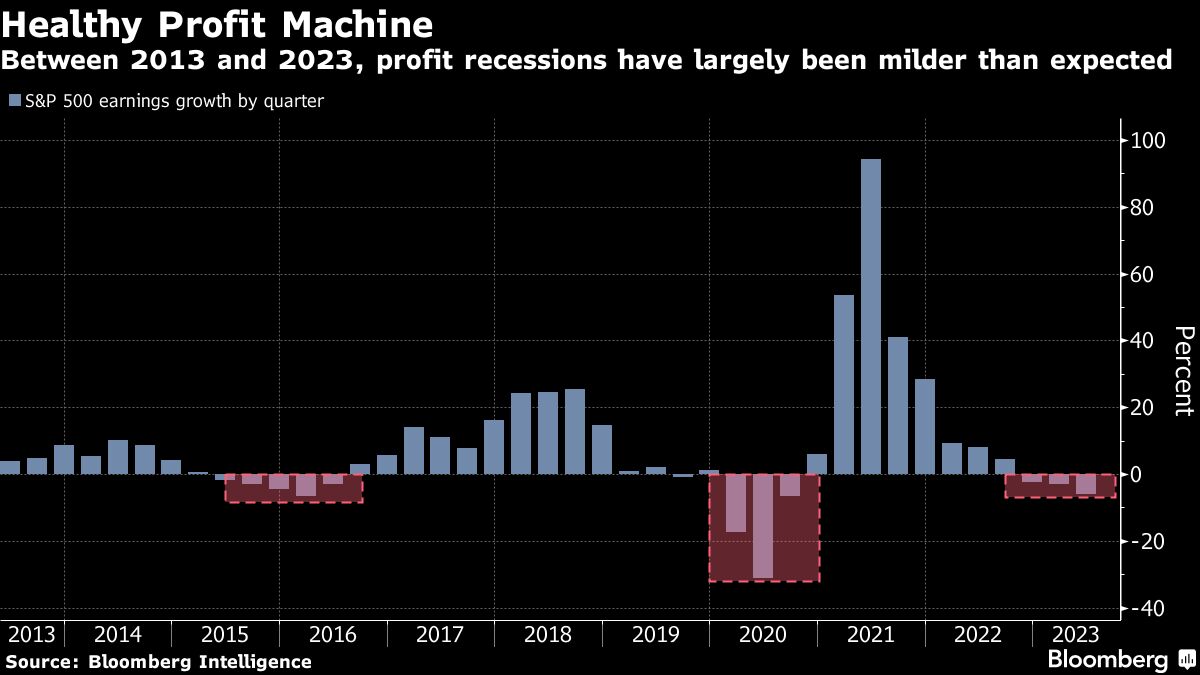

The S&P 500's decade-long bull run is facing challenges due to high valuations, making a repeat of the past decade's significant gains unlikely without unprecedented earnings growth or further valuation expansion. With the S&P 500's cyclically adjusted price-earnings ratio already above 30 times profits, analysts suggest that for stocks to appreciate, earnings must grow, valuations expand, or dividends increase. However, the end of near-zero interest rates and a shift in the economic structure may hinder the kind of multiple expansion seen in the past. Despite recent optimism and a rally in tech shares and junk bonds, the market's high valuation means it cannot rely on multiple expansion alone and will need substantial earnings growth to sustain high returns.

Reading Insights

0

1

4 min

vs 5 min read

88%

975 → 118 words

Want the full story? Read the original article

Read on Yahoo Finance