Natural Gas Prices Plummet Amidst LNG Facility Delay and Above-Average U.S. Temperatures

TL;DR Summary

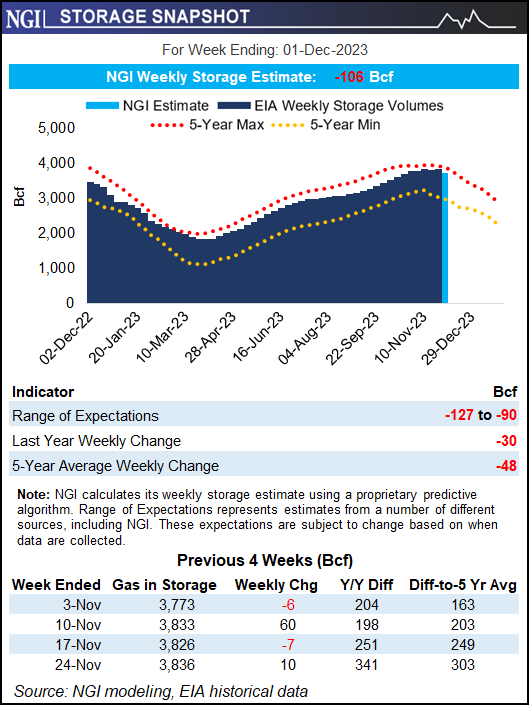

Natural gas futures plummeted after news of a delayed completion of a major LNG export facility intensified concerns about a storage glut. The decline was driven by robust production and weak weather-related demand. The front-month natural gas futures contract settled down 14.1 cents at $2.569/MMBtu, while February futures dropped 15.0 cents to $2.517. The spot gas national average also sank 52.5 cents to $3.030.

Topics:business#energy#lng-facility#natural-gas-futures#production#storage-glut-fears#weather-related-demand

- January Futures Crumbled as News of LNG Facility Delay Stokes Storage Glut Fears Natural Gas Intelligence

- Natural Gas Technical Analysis for December 08, 2023 by Chris Lewis for FXEmpire FX Empire

- Nat-Gas Prices Plunge on Forecasts for Above-Average U.S. Temps Nasdaq

- In Wake of Golden Pass Delay, January Natural Gas Nears $2.50 Ahead of EIA Data Natural Gas Intelligence

- Natural Gas Prices Forecast: Facing Downward Pressure Ahead of EIA Storage Data FX Empire

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

1 min

vs 2 min read

Condensed

79%

302 → 64 words

Want the full story? Read the original article

Read on Natural Gas Intelligence