Bitcoin's Future Uncertain as Options Market Signals Weakness Amid Debt Ceiling Drama.

TL;DR Summary

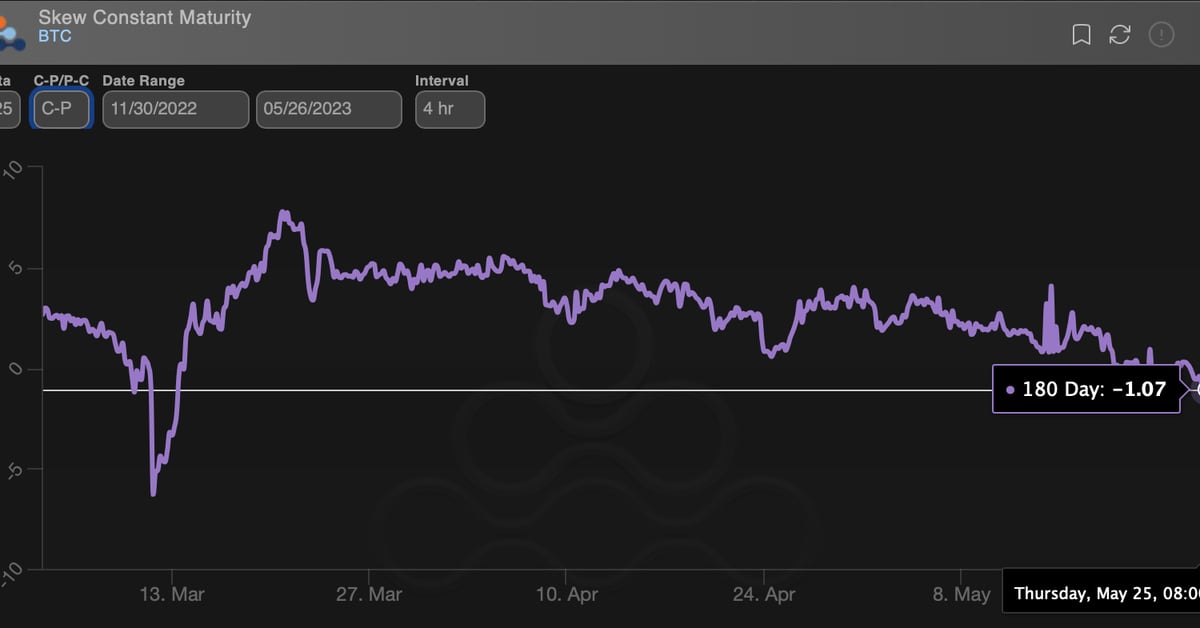

Bitcoin's options market is showing a bias for weakness over six months for the first time since early March as the US debt ceiling drama continues. The development is consistent with the recent flows in the S&P 500 market that show traders paying up for put volatility. Traders in crypto and traditional markets are starting to hedge against the US debt ceiling risks, considering Congress is struggling to raise the $31.4 trillion borrowing limit with less than a week until the government runs out of money to meet obligations.

- Bitcoin Options Market Signals Weakness over Six Months Amid Debt Ceiling Drama CoinDesk

- Bitcoin and ether slide as debt ceiling negotiations weigh on investors CNBC

- Bitcoin price hangs in the balance — Friday’s $2.26B BTC options could result in more downside Cointelegraph

- Investor Who Called Market Bottom Says Bitcoin (BTC) and Crypto Primed for Big Reversal – Here’s Why The Daily Hodl

- Bitcoin Under Siege: Support Breakdown Raises Concerns Of Drop To $24,000 - Report Bitcoinist

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

78%

410 → 89 words

Want the full story? Read the original article

Read on CoinDesk