"Bitcoin ETF Approval Sparks Selling Pressure and Sends BTC Soaring Past $47K"

TL;DR Summary

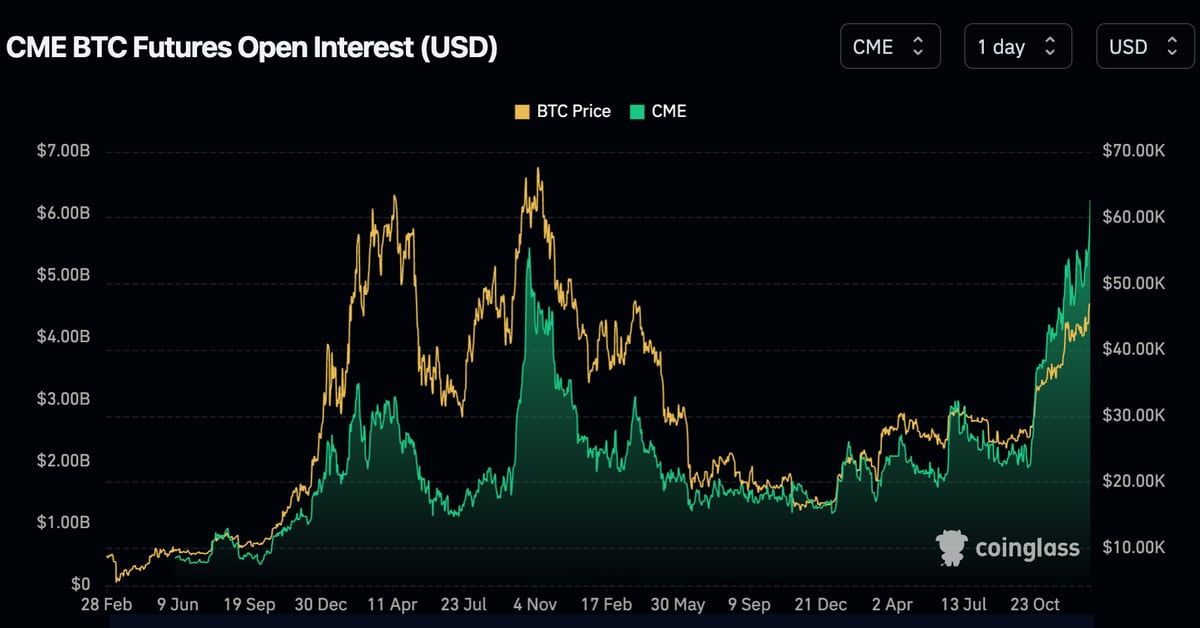

CME bitcoin futures open interest hit a record high of $6.2 billion as institutions anticipate a spot bitcoin ETF approval, but K33 Research predicts that approval will trigger selling pressure, causing investors to unwind positions. The report forecasts a decrease in open interest and premium if a spot-based bitcoin ETF is approved in the U.S., as investors rotate funds to cheaper spot ETFs, leading to selling pressure and potentially ending CME's all-time high regime.

- Spot Bitcoin ETF Approval Will Trigger 'Selling Pressure' on CME Futures Market: K33 CoinDesk

- Bitcoin hovers at 21-month high ahead of imminent spot ETF decision by SEC: CNBC Crypto World CNBC Television

- Bitcoin seesaws near $47,000 as ETF anticipation builds Yahoo Finance

- BTC Blasts Past $47K as Bitcoin ETF Excitement Gets Feverish CoinDesk

- Bitcoin touches highest level in nearly two years as deadline for spot ETFs looms: CNBC Crypto World CNBC Television

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

2 min

vs 2 min read

Condensed

81%

389 → 74 words

Want the full story? Read the original article

Read on CoinDesk