Meta's Strong Earnings Highlight AI Potential

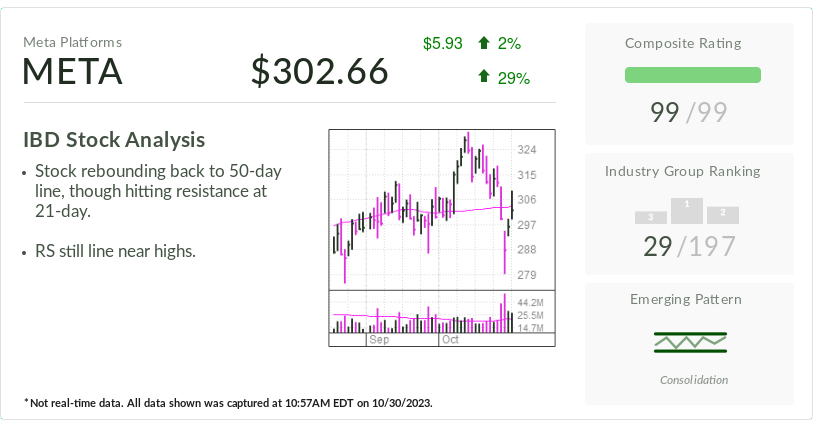

Meta Platforms, the parent company of Facebook, rebounded back to its 50-day line after reporting earnings that exceeded Wall Street's expectations and showcased progress in artificial intelligence. Despite a 3.7% drop in stock value following the earnings report, Meta's Relative Strength score remains high, indicating outperformance compared to the S&P 500. The company's Q3 earnings showed a 168% increase year-over-year, with a 23% sales growth, driven by the success of its automated ad campaign tools and cost-cutting measures. However, Meta cautioned about potential impacts on ad sales due to the Israel-Hamas conflict and provided a Q4 revenue outlook that fell short of analyst expectations. Additionally, Meta announced plans to offer ad-free subscription options in Europe to comply with evolving regulations.

- IBD Stock of the Day: Meta Earnings Underscore AI Promise Investor's Business Daily

- Meta Earnings; Reels Reaches Revenue Neutral; The Temu and Shein Effect Stratechery by Ben Thompson

- Alphabet's thrashing; Intel's recovery; Meta's warning: Weekly tech roundup By Investing.com Investing.com

- Meta's Massive Free Cash Flow Could Push the Stock Well Over $400 Barchart

- Insiders At Meta Platforms Sold US$12m In Stock, Alluding To Potential Weakness Yahoo Finance

Reading Insights

0

1

3 min

vs 4 min read

85%

784 → 120 words

Want the full story? Read the original article

Read on Investor's Business Daily