Tencent Doubles Buybacks to Over $12.8 Billion as Sales Miss, Q4 Profit Slumps

TL;DR Summary

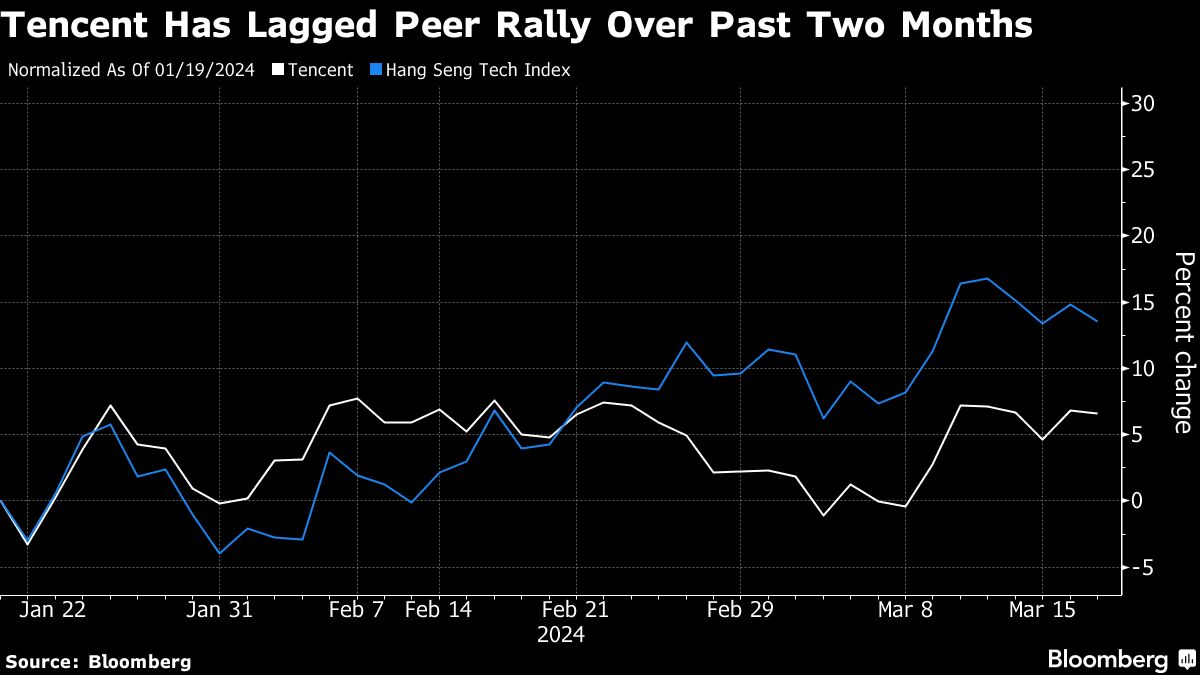

Tencent Holdings Ltd. plans to double its stock buyback program to at least $12.8 billion in 2024 after reporting a lower-than-expected 7% rise in revenue, with gaming sales disappointing, particularly in China. The move aims to mollify investors concerned about a gradual dissipation of growth during a Chinese economic downturn. Tencent faces challenges in retaining paid subscribers for its video and music streaming services, and its cloud computing arm is engaged in a price war with Alibaba and JD. The company is also seeking its next big hit in the gaming sector amidst regulatory uncertainties.

- Tencent Doubles Buybacks to Over $12.8 Billion as Sales Miss Yahoo Finance

- China's Tencent posts weak revenue growth, plans to double buybacks Reuters

- Tencent's Fourth-Quarter Net Profit Likely Slumped Despite Higher Revenue -- Earnings Preview MarketWatch

- Tencent's Q4 profit drops 75% and revenue misses expectations Nikkei Asia

- Tencent doubles share buy-backs while earnings miss estimates South China Morning Post

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

4 min

vs 5 min read

Condensed

90%

936 → 95 words

Want the full story? Read the original article

Read on Yahoo Finance