Firefighters respond to blaze at Salem TD Bank

Firefighters in Salem County, New Jersey, responded to a blaze at a TD Bank in a strip mall on Christmas Day, which was brought under control with no injuries reported; the cause is under investigation.

All articles tagged with #td bank

Firefighters in Salem County, New Jersey, responded to a blaze at a TD Bank in a strip mall on Christmas Day, which was brought under control with no injuries reported; the cause is under investigation.

TD Bank Group reported strong third quarter 2025 financial results with reported net income of $3.3 billion and adjusted net income of $3.9 billion, driven by robust client activity across its Canadian and U.S. operations, despite ongoing strategic restructuring and regulatory remediation efforts.

Fiserv's stock dropped over 19% in 2025 despite beating quarterly revenue and EPS estimates, due to a softened outlook and multiple analyst downgrades. The company reported solid growth in revenue and margins, expanded its presence in Canada through a strategic deal with TD Bank, including acquiring part of TD's merchant processing business, and maintained an optimistic revenue and EPS outlook for the year.

A former TD Bank employee, Leonardo Ayala, has been arrested and charged with facilitating money laundering to Colombia. Ayala allegedly used his position to issue debit cards for accounts opened under shell companies, which were then used to launder millions in narcotics proceeds through ATM withdrawals in Colombia. He faces up to 20 years in prison if convicted. The case is being investigated by multiple federal agencies, and Ayala's trial will take place in New Jersey.

A former TD Bank employee in Florida, Gerry Aquino Vargas, is accused of opening fraudulent accounts and accepting bribes to help clients move millions to Colombia, bypassing anti-money-laundering measures. The bank is cooperating with a U.S. Department of Justice investigation related to a $653 million drug money-laundering case.

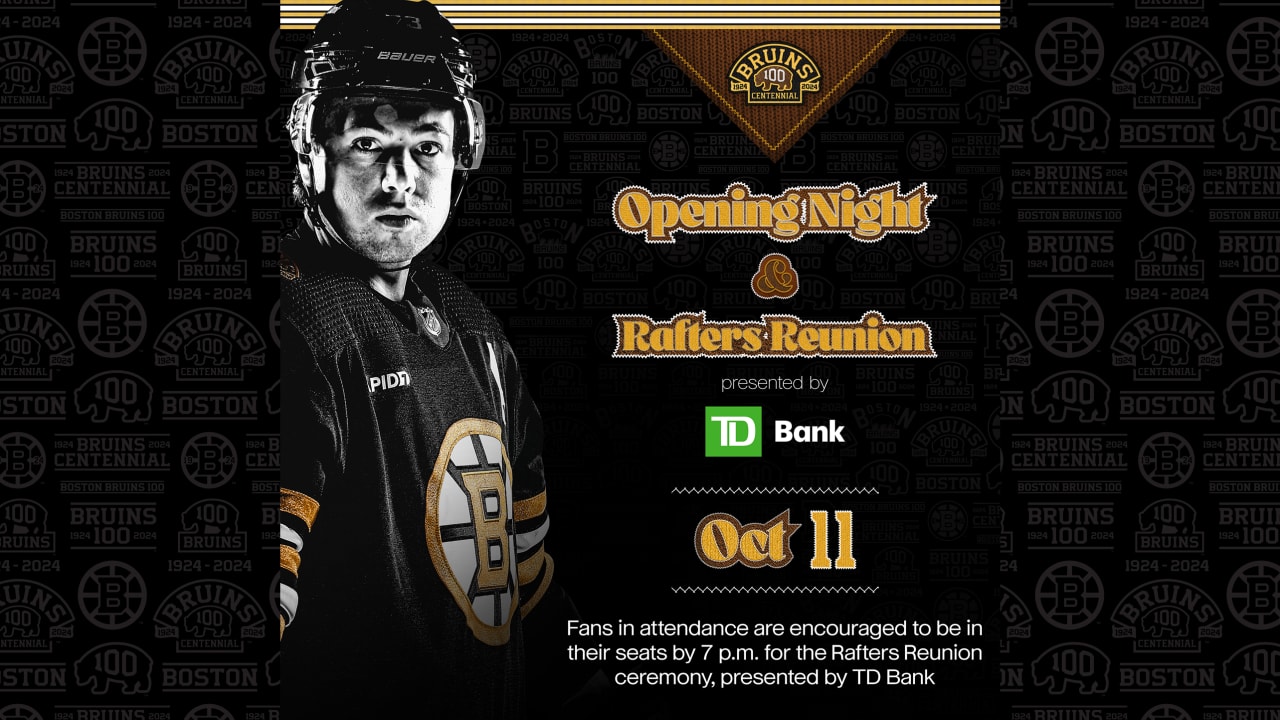

The Boston Bruins have announced special initiatives for the start of their Centennial Year, including a "Rafters Reunion" opening ceremony and a "gold carpet" entrance for Bruins alumni. Ticketed fans will receive an exclusive t-shirt, and the Boston Bruins Foundation 50/50 raffle will feature a $100,000 guarantee with proceeds benefiting the foundation. The ProShop will be open for fans to purchase Centennial jerseys and merchandise. The Bruins' Centennial celebration aims to unite fans, alumni, and associates and celebrate the team's rich history.

Royal Bank of Canada (RBC) plans to cut about 1,800 jobs to reduce costs after beating analysts' estimates for the third quarter, citing a softer economy ahead. RBC's CEO, Dave McKay, expects slowing growth and lower inflation due to monetary policy, a slowdown in China, and geopolitical risks. Meanwhile, TD Bank missed analysts' estimates for quarterly profit due to higher expenses, rainy day funds for unpaid loans, and weakness in its U.S. business. RBC's retail business saw a 5% increase in earnings, while TD's Canadian personal and commercial banking segment fell 1% and its U.S. retail unit fell 9%.

TD Bank and First Horizon have terminated their merger agreement due to a lack of clarity on regulatory approvals. TD will pay First Horizon $200 million on top of a $25 million reimbursement fee. The merger would have made TD the sixth-largest bank in the US by assets. The termination could have broader repercussions for TD's future partnerships and deployment of excess capital.

TD Bank has called off its $13.4 billion acquisition of First Horizon Corp due to regulatory uncertainty. TD will pay $200 million to First Horizon, in addition to a $25 million fee reimbursement. The collapse of the deal further spooked already shaky sentiment towards U.S. regional banks. TD agreed to buy First Horizon in February last year to expand its presence in the United States.

Shares of regional bank First Horizon plummeted by 50% after its planned merger with TD Bank collapsed. The stock market reacted negatively to the news, with other regional bank shares also experiencing a drop. The collapse of the merger came just a day after JPMorgan announced its acquisition of First Republic.