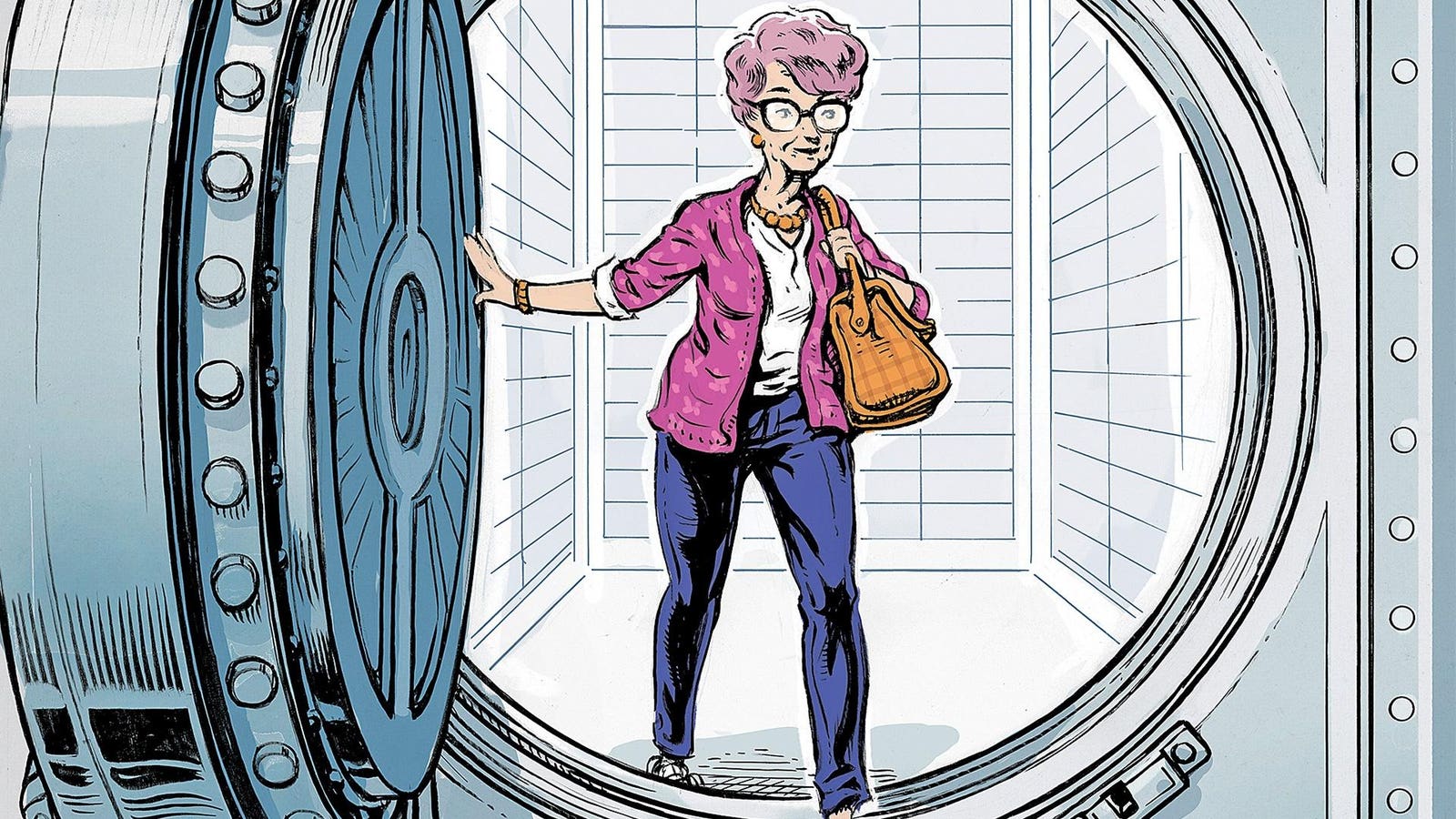

"Unlocking Financial Freedom: Harnessing the Power of Family Loans to Overcome High Interest Rates"

With interest rates on personal loans and mortgages climbing, borrowing from family members, particularly affluent Baby Boomers, can be a smart alternative. However, it's important to follow tax rules and proper documentation. Charging the applicable federal rate (AFR) is crucial to avoid potential tax complications. Intrafamily loans can offer benefits such as deductibility of interest and asset protection. Forgiving loans over time can also be a strategy for utilizing gift and estate tax exemptions. Advanced techniques like combining loans with intentionally defective grantor trusts (IDGTs) can further optimize wealth transfer. Proper planning and legal advice are essential to ensure a successful borrowing arrangement from the "Bank of Grandma."