Berkshire Resumes Buybacks as Abel Commits Salary-Funded Stock Purchases

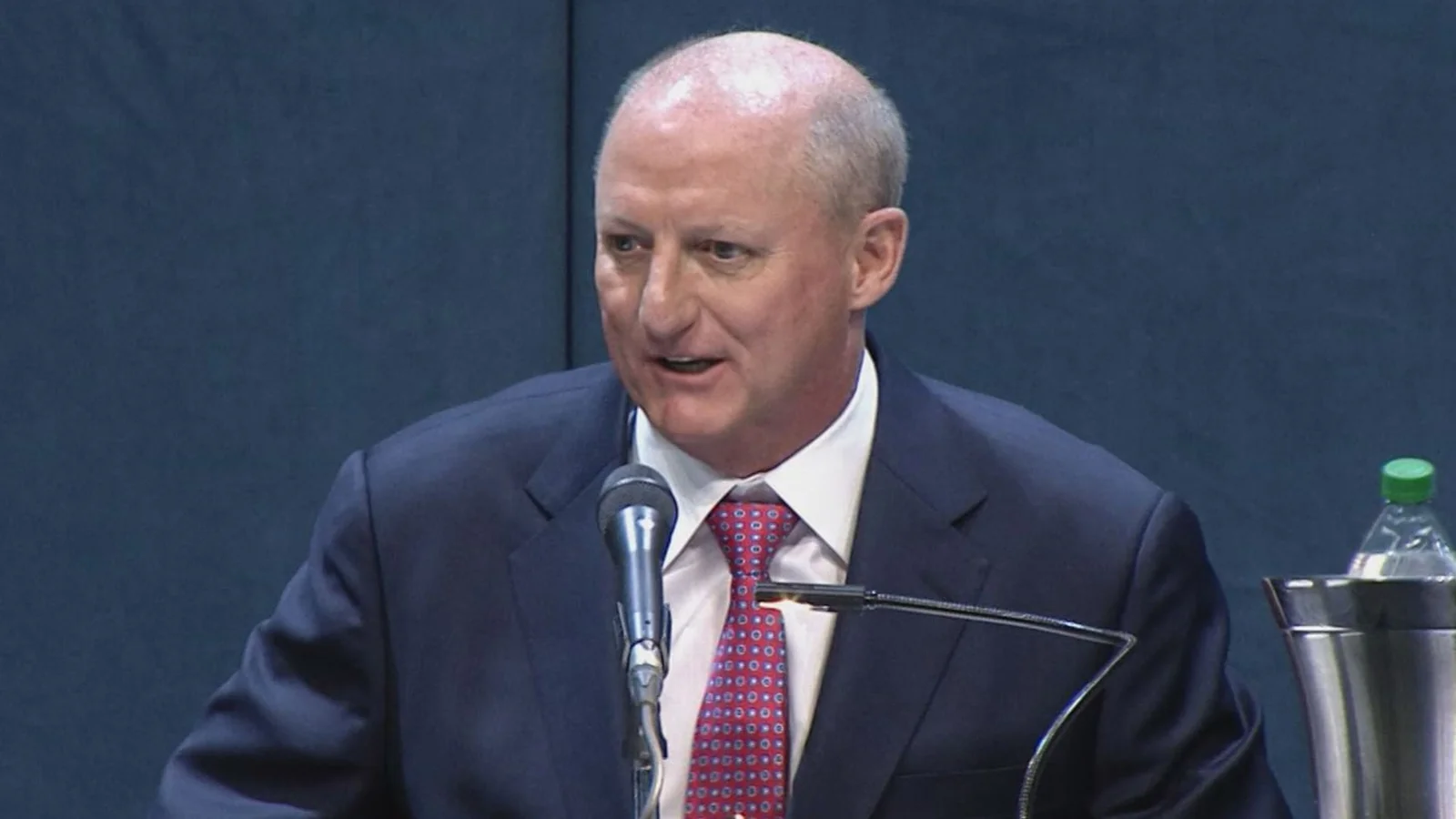

Berkshire Hathaway said it has restarted share repurchases, with new CEO Greg Abel buying $15 million of Berkshire stock personally and vowing to fund annual purchases with his after-tax salary, after consulting Warren Buffett and signaling alignment with shareholders during the leadership transition.