"Analysts Raise Micron Stock Price Target Ahead of Earnings Report"

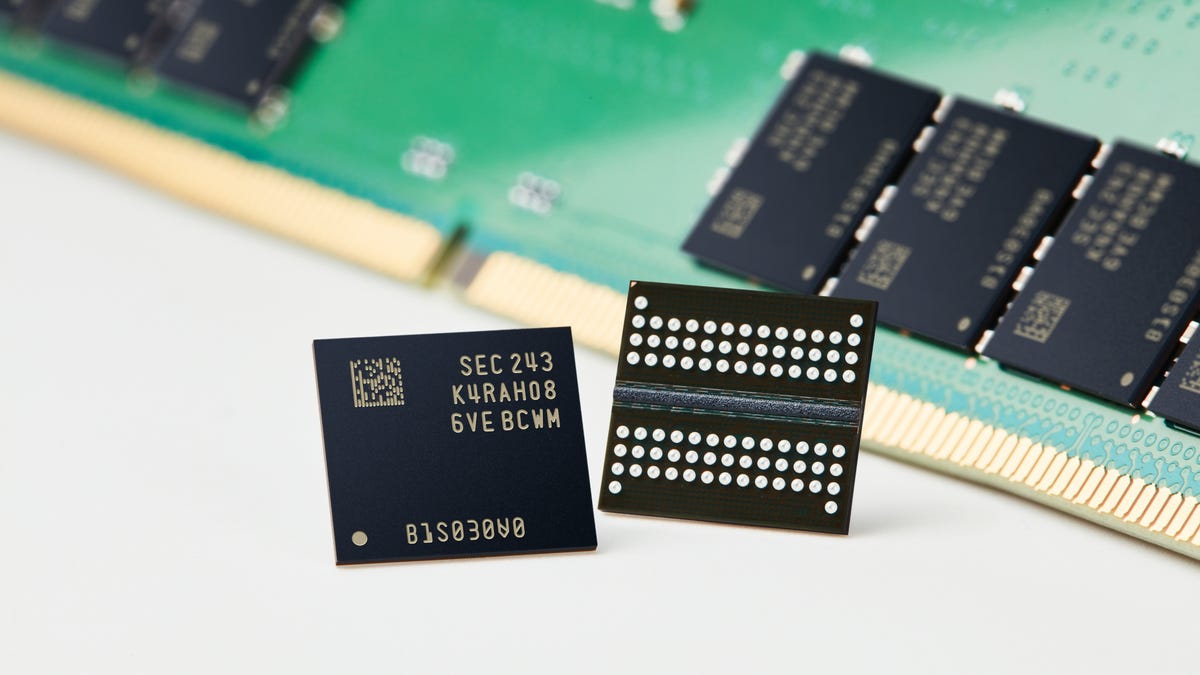

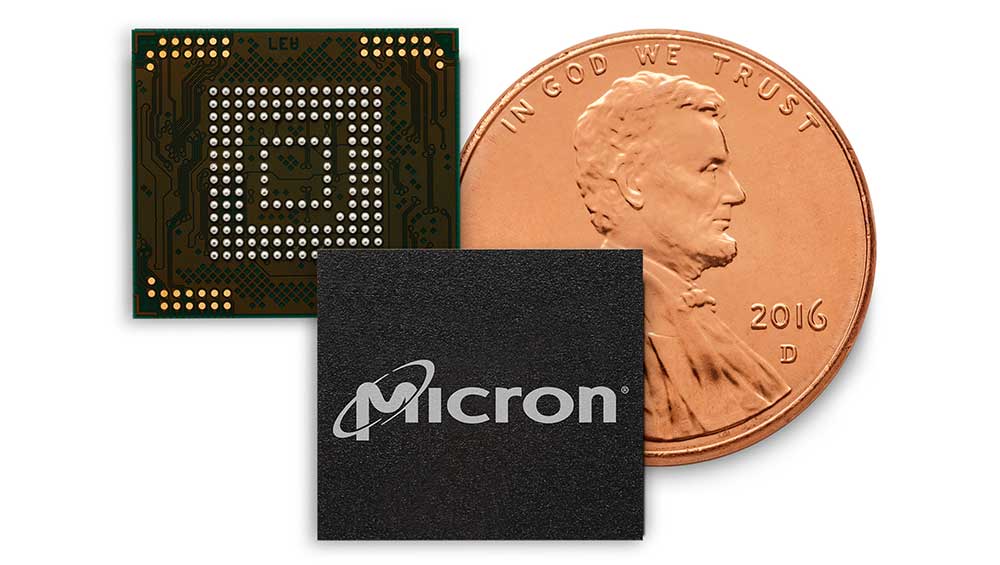

Micron Technology's stock received a price-target hike ahead of its upcoming earnings report, as a Wall Street analyst predicts a strong outlook for the company in 2024 due to a recovering memory-chip market. The analyst reiterated a buy rating on Micron stock and raised the 12-month price target. Micron stock surged 3.8% higher on the news. The company is expected to deliver strong guidance in its quarterly report and continue its upward trend in 2024.