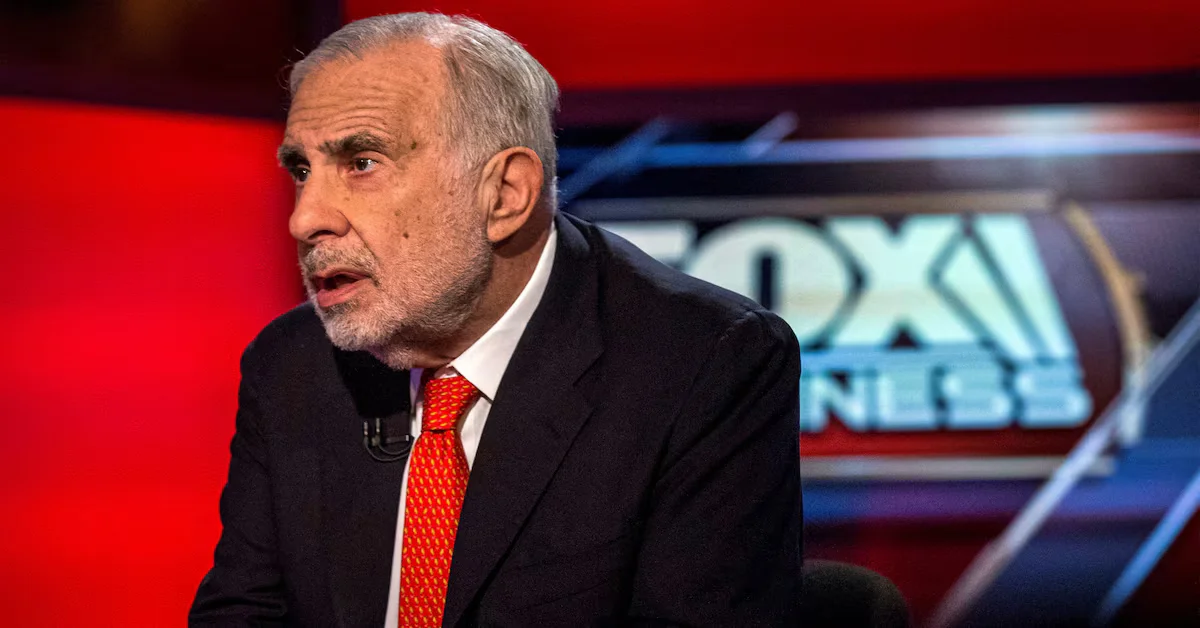

Carl Icahn's Investing Arm Suffers 61% Losses in August.

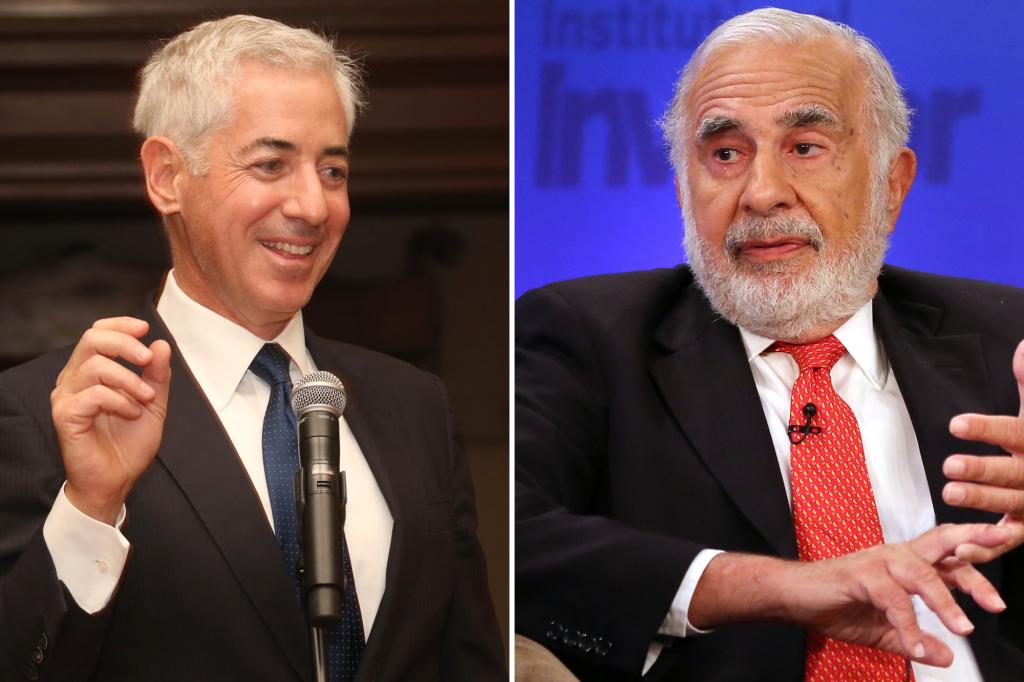

Icahn Enterprises LP's stock fell another 3% on Friday, extending its month-to-date losses to 61%. The stock has been under pressure since a May 2 report by Hindenburg Research accused Icahn's publicly traded investment vehicle of inflating asset values. The report has cost IEP more than $10.9 billion in lost market cap. Bill Ackman, founder and CEO of Pershing Square Capital Management, weighed in on the Hindenburg report with some thoughts of his own, reviving a longstanding feud between the two billionaires.