Market Movers and Key Stocks to Watch This Week

The article highlights the most active stocks today, including TSMC, Salesforce, HPE, Travelers, Charles Schwab, J.B. Hunt, and Praxis Precision, among others, indicating significant market movements.

All articles tagged with #hpe

The article highlights the most active stocks today, including TSMC, Salesforce, HPE, Travelers, Charles Schwab, J.B. Hunt, and Praxis Precision, among others, indicating significant market movements.

U.S. intelligence intervened with the DOJ to support the HPE-Juniper merger, citing national security concerns related to China and Huawei, with the aim of strengthening U.S. business competitiveness against Chinese rivals.

The UK High Court ruled that the estate of Mike Lynch owes Hewlett Packard Enterprise over $940 million due to a fraud case related to Lynch's company Autonomy, with Lynch's yacht sinking and his death occurring shortly after the ruling. The case involves allegations of misrepresentation and fraud in the sale of Autonomy, which HP acquired for $11 billion, and the court's decision reflects significant financial damages awarded to HPE. A further hearing is scheduled to determine final damages and other legal considerations.

The estate of Mike Lynch, founder of Autonomy, was ordered to pay HPE approximately $943 million after a UK court found that HPE's claim of overpayment and fraud in the Autonomy acquisition was exaggerated. The judge determined the actual loss to be around $700 million, significantly less than the $4 billion HPE initially sought. Lynch, who died in a yacht accident last year, was cleared of criminal charges related to the sale.

HPE has issued a warning about critical security vulnerabilities in Aruba Instant On Access Points, including hardcoded credentials that could allow attackers to bypass authentication and gain control, and a command injection flaw. Users are advised to update to firmware version 3.2.1.0 or later to mitigate these risks, as no workarounds are available.

Hewlett Packard Enterprise's acquisition of Juniper Networks received U.S. Department of Justice approval, boosting HPE's stock and creating a stronger competitor in the data center networking market, though a requirement to sell a license for Juniper's Mist AI platform could pose future challenges.

Hewlett Packard Enterprise's $14 billion acquisition of Juniper Networks was approved by the Department of Justice after a settlement that included divestments and open sourcing of Juniper's AI Ops for Mist, aiming to enhance HPE's position in AI-driven network solutions. Shares of both companies surged following the announcement.

HPE's acquisition of Juniper Networks' AI Ops for Mist is subject to strict government conditions, including licensing of the source code to up to two bidders via auction, transfer of 55 Juniper employees, and ongoing oversight to ensure compliance and transition support, with the US government holding final approval rights.

The DOJ approved HPE's $14 billion acquisition of Juniper Networks after a settlement that requires licensing of Juniper's Mist AI software and divestment of HPE's wireless business, paving the way for HPE to challenge Cisco in the AI networking market and offering a new alternative for customers.

U.S. stock futures are slightly higher amid ongoing trade tensions, with mixed corporate earnings reports influencing individual stocks: CrowdStrike drops after soft revenue outlook, HPE surges on strong results, and Dollar Tree falls due to tariff concerns despite solid Q1 performance. President Trump comments on difficulties in negotiating with China, adding to market uncertainty.

Hewlett Packard Enterprise (HPE) saw its stock rise to a record high following a strong quarterly revenue report, driven by a 16% increase in AI system sales and a 32% jump in server unit sales. Despite the positive sales figures, HPE's server revenue slightly missed analyst expectations, and concerns remain about the lower margins of AI servers due to costly semiconductors. HPE's total revenue rose 15% to $8.46 billion, surpassing estimates, but adjusted gross margins fell slightly short of expectations. The company is also planning a $14 billion acquisition of Juniper Networks, which has attracted regulatory scrutiny.

Hewlett Packard Enterprise (HPE) reported a slowdown in AI server growth for its fiscal fourth quarter, but Wall Street remains optimistic about its long-term prospects due to expected recovery in IT spending and benefits from the Juniper Networks acquisition. Despite missing AI server revenue estimates, HPE's overall earnings and revenue exceeded expectations, leading to a 1% rise in stock price. Analysts highlight the potential for increased earnings from networking and cloud services post-acquisition, despite the added debt from the Juniper deal.

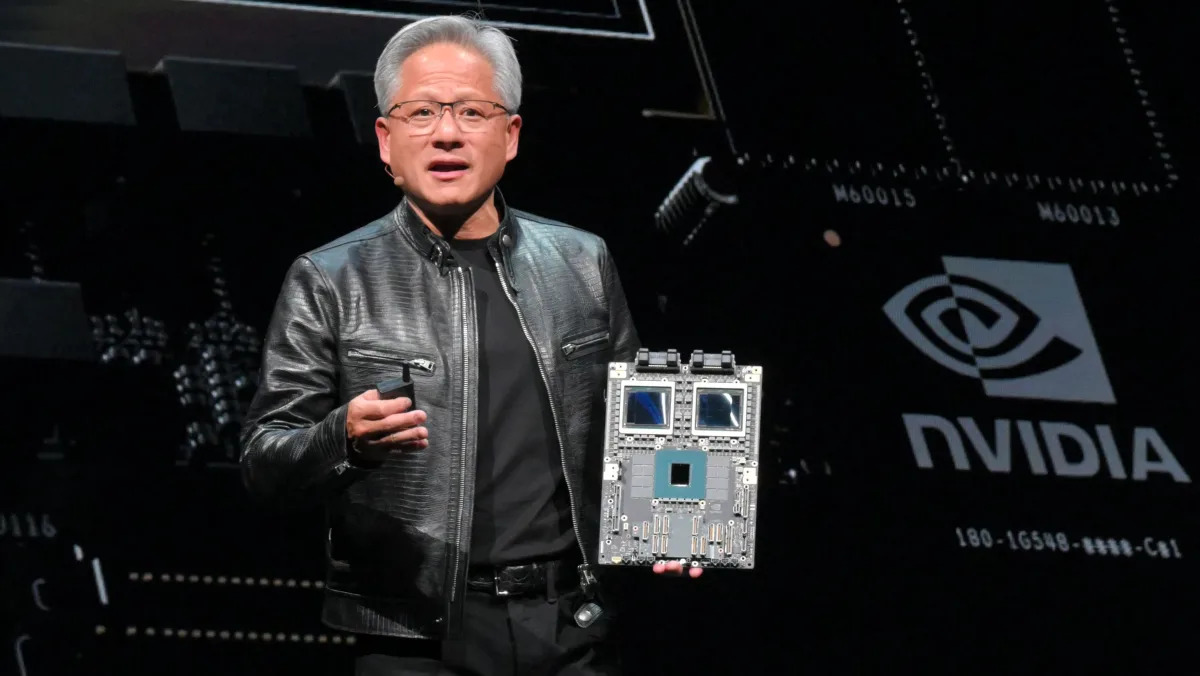

Hewlett Packard Enterprise (HPE) reported a 3% revenue growth in its fiscal second quarter, driven by strong AI server sales, particularly with AI chips from Nvidia. Despite surpassing revenue estimates, earnings fell by 19%, and profitability remains a challenge. HPE raised its full-year revenue and earnings guidance, highlighting a strong order book and improved supply chain. Dell also saw significant AI system sales but faced similar profitability issues. Both companies need to find ways to enhance profits from AI server sales.

HPE CEO Antonio Neri highlights the significant role of Nvidia in advancing AI technology, noting that Nvidia's innovations are "changing the world." HPE has also benefited from AI, with its stock rising after strong quarterly results. Nvidia's market cap recently surpassed $3 trillion, driven by high demand for its AI platforms.

Hewlett Packard Enterprise (HPE) CEO Antonio Neri highlights the company's strong Q2 performance and its significant role in AI, with an AI order book of $4.6 billion and $900 million in revenue conversion. Neri emphasizes HPE's unique position in the AI market, particularly in energy-efficient liquid cooling solutions, and anticipates continued demand growth.