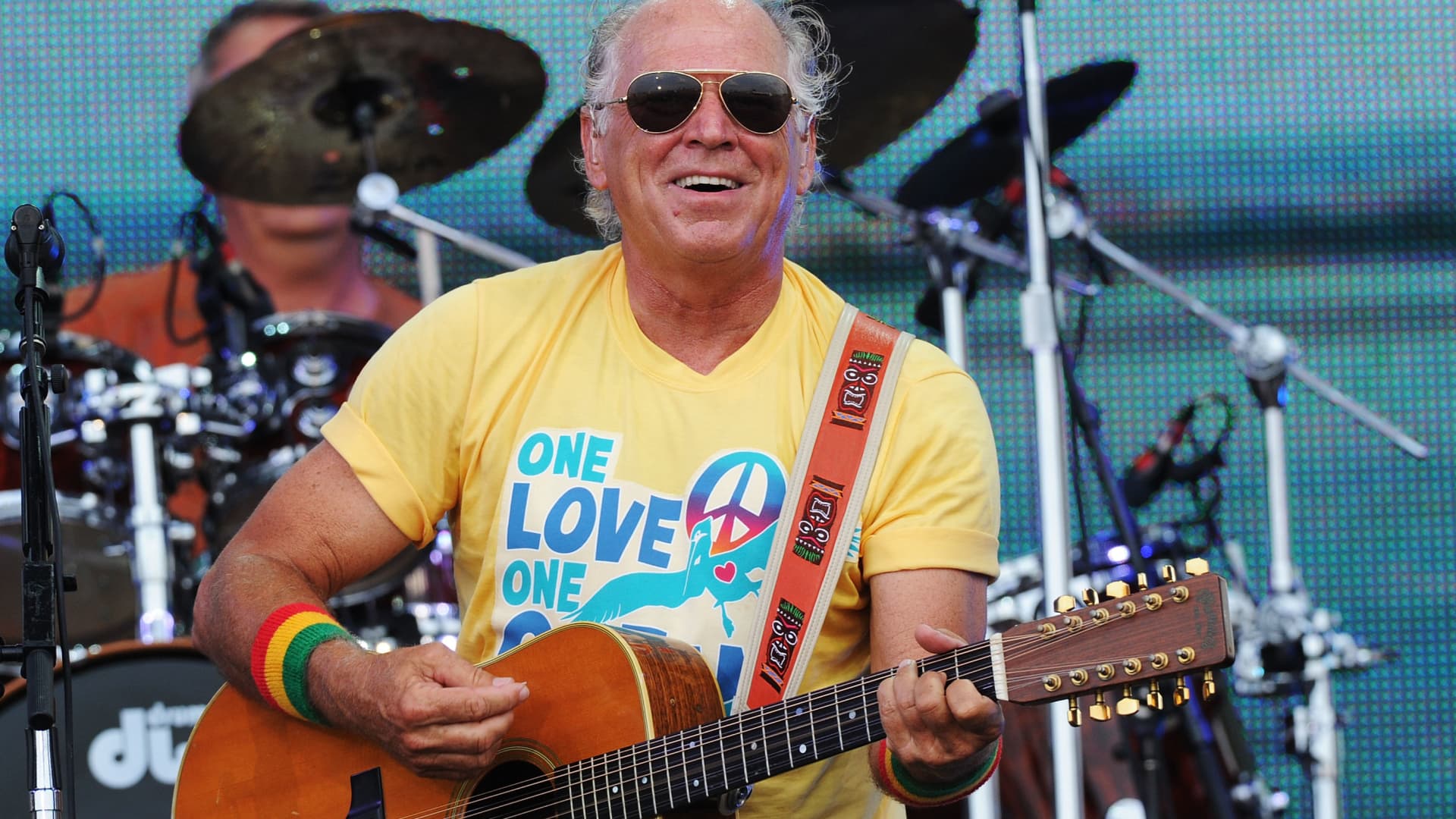

Jimmy Buffett's $275M Estate Sparks Family Trust Dispute

A legal battle over Jimmy Buffett's $275 million estate has highlighted the risks and complexities of family trusts, with disputes arising between his widow and co-trustee over management, fees, and control, reflecting broader issues in estate planning and inheritance litigation.