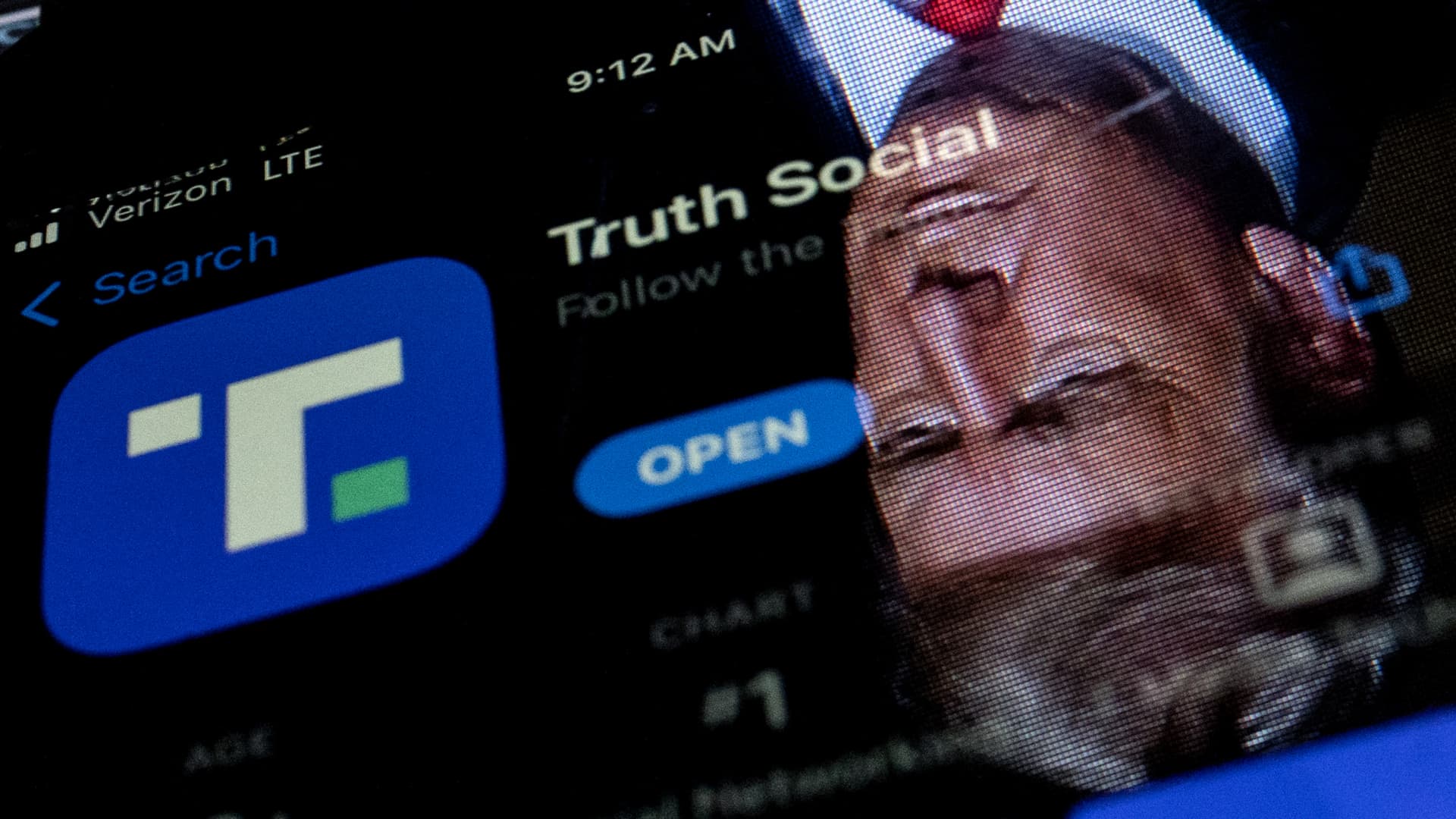

Trump Media Stock Volatile Amid Election Day Surges and Halts

DJT stock surged up to 25% after Donald Trump won the presidential election against Kamala Harris, securing his position as the 47th US president. The stock, linked to Trump's media company and social platform Truth Social, experienced significant volatility, reflecting a "buy the rumor, sell the fact" trading strategy. Trump's victory increased his stake in the company to approximately $4.4 billion. The stock's performance has been closely tied to election outcomes, with strategists noting its meme-stock characteristics.