Amazon Expands Sports Streaming as Diamond Sports Restructures

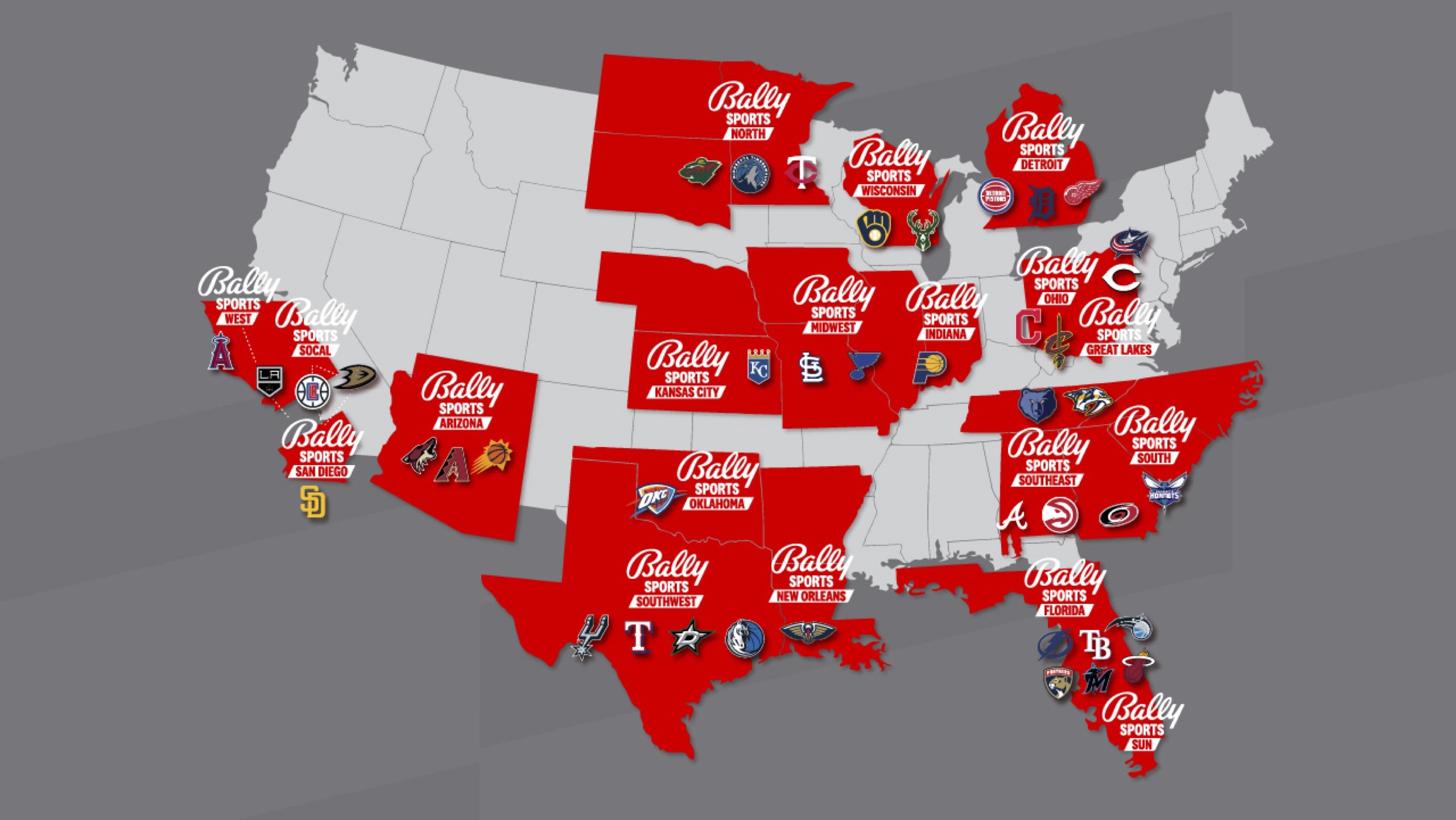

Diamond Sports Group has received court approval to exit Chapter 11 bankruptcy with a new business model that includes a streaming partnership with Amazon's Prime Video and a naming rights deal with FanDuel. This plan allows the company to continue broadcasting for 27 MLB, NHL, and NBA teams, despite some teams leaving due to financial concerns. The new model aims to offer fans in certain markets the ability to access games without a traditional cable package.