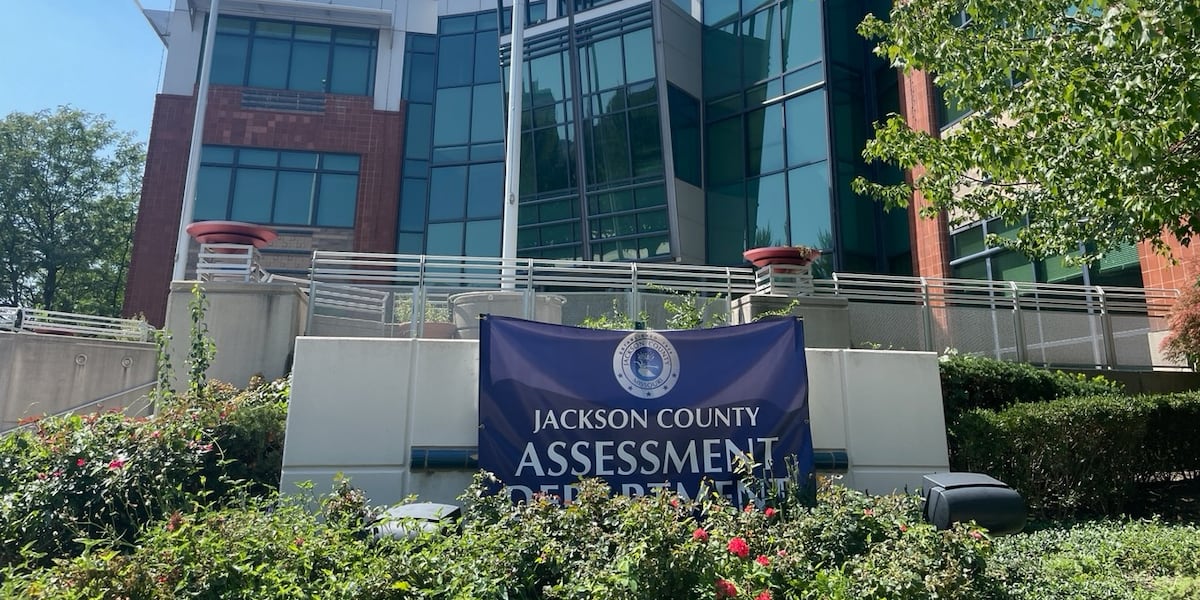

Jackson County Property Tax Assessment Criticized by State Auditor

TL;DR Summary

The Missouri State Auditor has released a preliminary audit stating that the Jackson County Assessment Department failed to comply with state law, with property values that increased over 15% likely being invalid. Approximately 69% of homes in Jackson County are affected. The audit calls for solutions such as limiting 2023 values to 15%, using prior years' assessed valuations, or allowing additional appeals. The audit also revealed a lack of physical inspections and failure to notify homeowners of their rights. Over 55,000 appeals were filed, and the state auditor's office will issue a final report in 2024.

Topics:nation#compliance#government#homeowners#jackson-county#missouri-state-auditor#property-tax-assessment

- State auditor blasts Jackson County in initial review of property tax assessment KCTV 5

- Missouri auditor: Jackson County assessment process violated state law KSHB 41 Kansas City News

- As Jackson County property are taxes due, one retiree questions how she’ll be able to pay KCTV 5

- Home values rose the most in these Kansas City ZIP codes Kansas City Star

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

2 min

vs 3 min read

Condensed

80%

475 → 96 words

Want the full story? Read the original article

Read on KCTV 5