Paramount's Strategic Shift: From Merger Woes to Tech Ambitions

TL;DR Summary

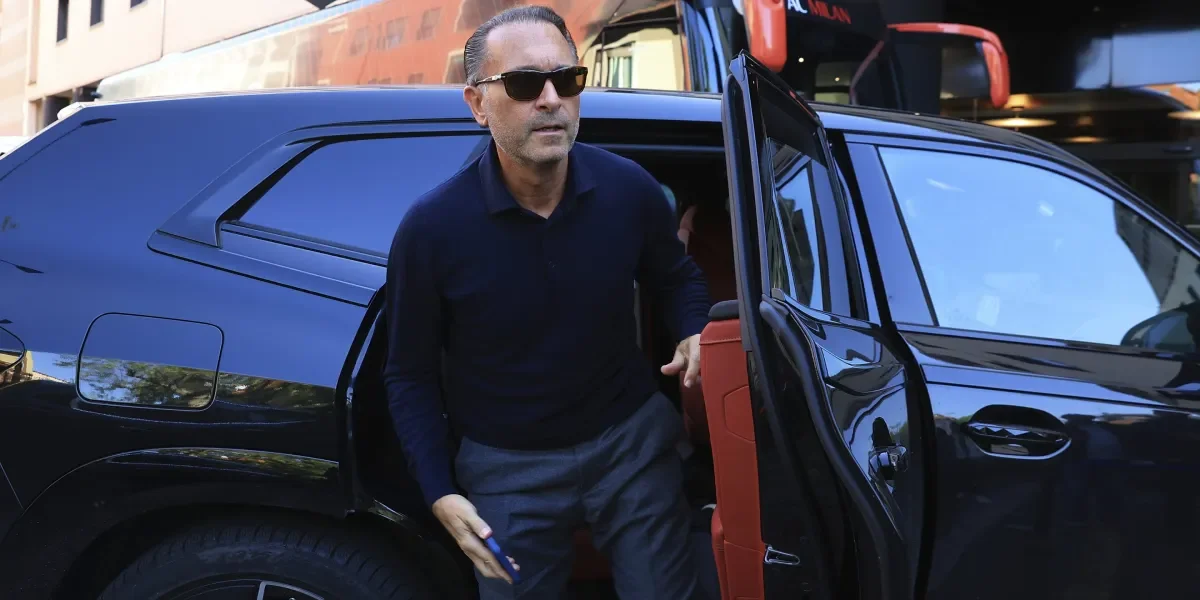

RedBird Capital's Gerry Cardinale played a key role in the $8.4 billion merger of Paramount and Skydance, marking a significant shift in Hollywood with private equity's increasing influence. Cardinale, an outsider with a focus on IP monetization and cost efficiency, aims to leverage Paramount's extensive IP assets to adapt to the streaming era, while navigating industry challenges such as declining linear TV and high debt.

- RedBird Capital’s $2 billion power play: Meet Gerry Cardinale, the private equity kingmaker behind the Paramount–Skydance deal Fortune

- A Message From Our Chairman and CEO paramount.com

- Inside the first day of Paramount’s new regime under David Ellison CNN

- The Paramount Merger Was a Bad Deal for Old Shareholders. Buying the Stock Is a Good Bet for New Ones. Barron's

- Can Paramount Pivot to Big Tech? David Ellison Outlines His Silicon Valley Vision The Hollywood Reporter

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

7 min

vs 8 min read

Condensed

96%

1,518 → 65 words

Want the full story? Read the original article

Read on Fortune