Social Security Alert: Risks and Misconceptions for Retirees in 2024

TL;DR Summary

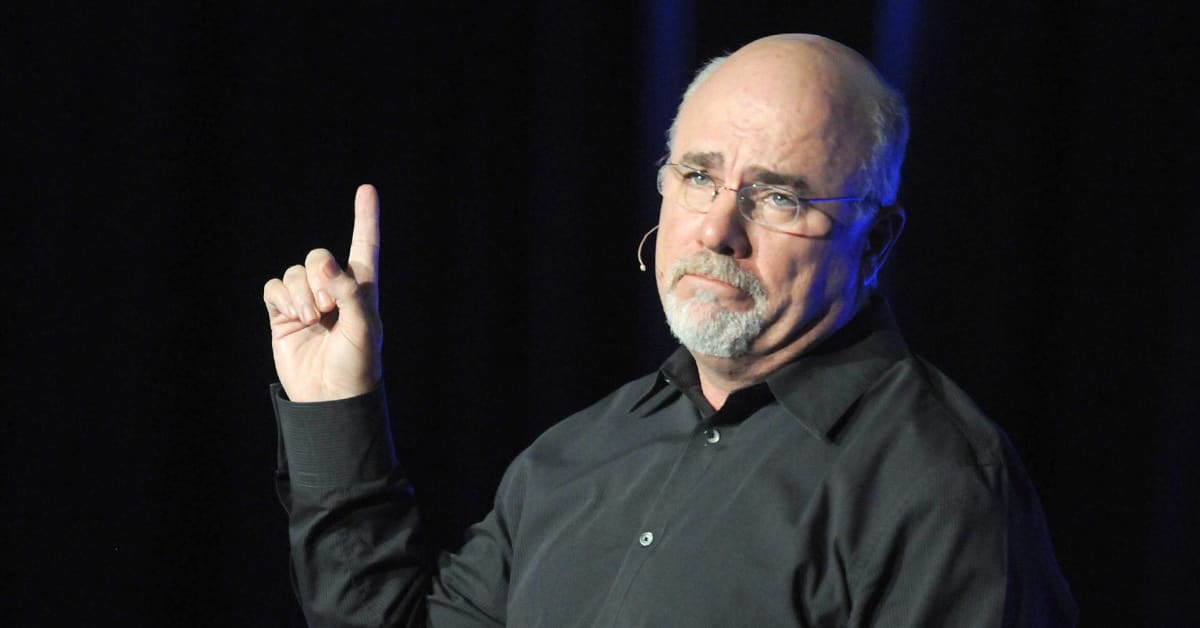

Personal finance expert Dave Ramsey advises Americans to avoid relying on Social Security as their primary retirement income, calling it "dumb with a capital D." He recommends investing 15% of income into retirement accounts, starting with a 401(k) match and then a Roth IRA. Ramsey also warns about potential Social Security solvency issues, with projections indicating the trust fund may only cover 79% of benefits by 2033 without legislative changes. Additionally, proposals from Donald Trump could worsen Social Security's financial outlook, potentially leading to insolvency by 2031.

Topics:business#401k#dave-ramsey#investment-strategy#personal-finance#retirement-planning#social-security

- Dave Ramsey warns Americans on Social Security and 401(k)s TheStreet

- Saying goodbye to Social Security checks - List of retirees who will lose benefits - Cases confirmed La Grada EN

- 5 Social Security lies American retirees keep falling for — how many are hurting you in 2024? MSN

- Confirmed: Social Security retirement payments will be cancelled for adults who have not made this procedure Tododisca

- 5 Things That Put Your Social Security Benefits at Risk Yahoo Finance

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

3 min

vs 4 min read

Condensed

86%

615 → 87 words

Want the full story? Read the original article

Read on TheStreet