AI's Fragile Backbone: Why a Supply-Chain Hiccup Could Topple 2026 Markets

TL;DR Summary

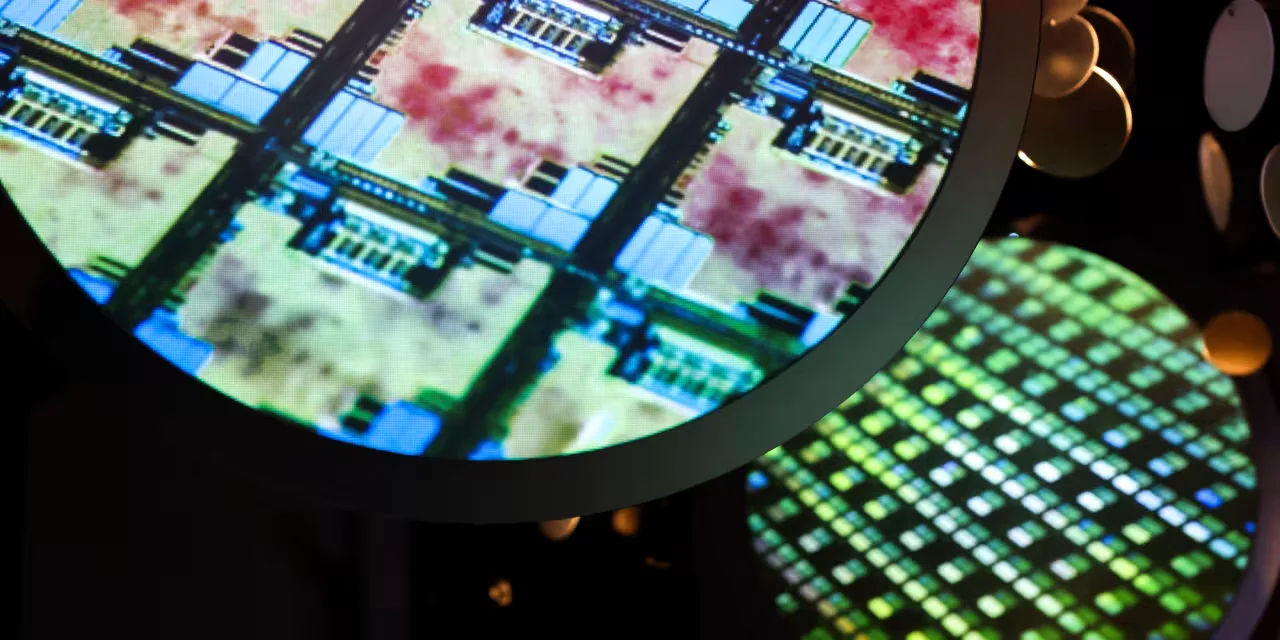

Market strategist Scott Helfstein of Global X warns that a small disruption in the AI supply chain—centered on semiconductors concentrated in Taiwan (TSMC) and critical EUV equipment from ASML—could disproportionately unsettle market expectations in 2026, alongside concerns about Fed credibility, elevated trade tensions, energy geopolitics, and domestic policy brinkmanship.

- Why a ‘hiccup’ in the AI supply chain is a top market risk for 2026 MarketWatch

- ‘Show me the money’ time for AI as political risks loom Politico

- The Earnings Season is Still All About AI and Big Tech. That Won’t Last. Barron's

- Microsoft, Alphabet, Amazon Poised For 'Very Strong' Q4 Earnings, Says Dan Ives: 'This Is A Mid-1996 Moment' Benzinga

- Dan Ives Predicts $3 Trillion AI Spending Over Next Three Years, Sees Strong Earnings Ahead Intellectia AI

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

23 min

vs 24 min read

Condensed

99%

4,630 → 49 words

Want the full story? Read the original article

Read on MarketWatch