Unveiling the Truths and Myths of Social Security's Future

TL;DR Summary

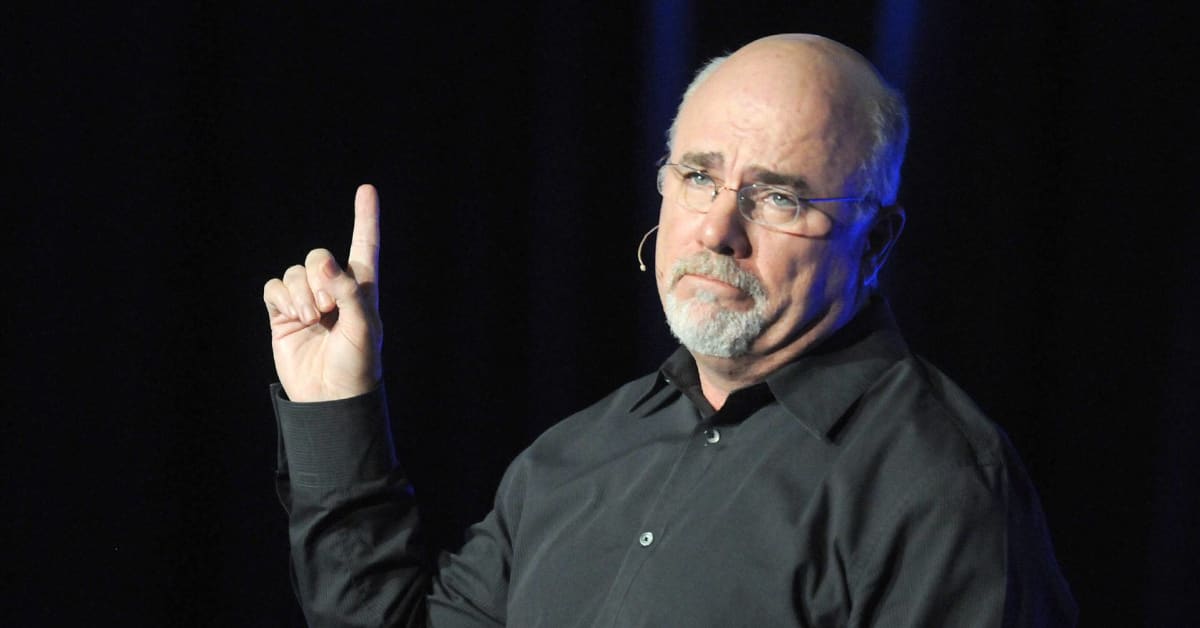

Dave Ramsey, a personal finance expert, warns retirees about the potential challenges facing Social Security, highlighting a report that suggests the program will be fully funded only until 2034. After that, beneficiaries might receive about 80% of their expected payments unless legislative action is taken. Ramsey advises workers to invest 15% of their income in retirement savings, utilizing employer 401(k) matches and Roth IRAs, to mitigate reliance on Social Security.

- Dave Ramsey sounds alarm on Social Security for retired Americans TheStreet

- The myths that hide why Social Security is unsustainable The Boston Globe

- 8 Things You Must Know About Social Security The White Coat Investor

- Goodbye to Social Security checks - These are the other benefits that almost no one knows about from the SSA La Grada EN

- Social Security just turned 89 — but after all those years, many Americans still don’t understand how the program works. Here’s everything you need to know MSN

Reading Insights

Total Reads

0

Unique Readers

9

Time Saved

3 min

vs 4 min read

Condensed

90%

679 → 70 words

Want the full story? Read the original article

Read on TheStreet