Bitcoin's Rollercoaster Ride: From All-Time Highs to Sharp Pullbacks

TL;DR Summary

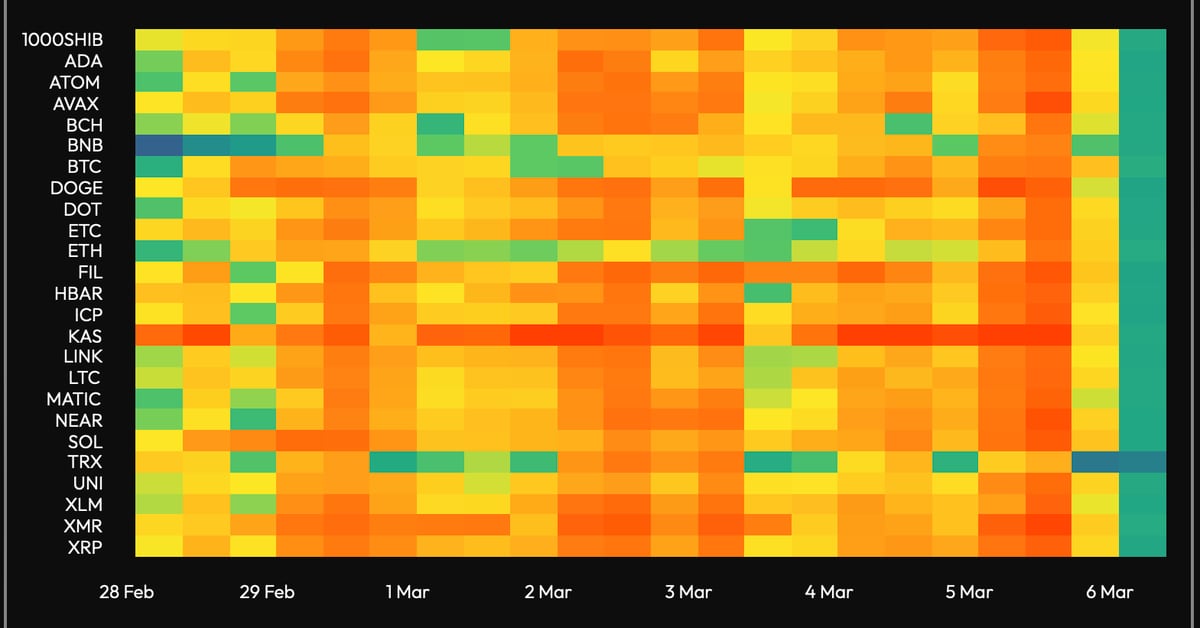

Bitcoin's sharp pullback from its record high of $69,000 has led to a normalization of funding rates in the crypto perpetual futures market, with the annualized funding rates for the top 25 cryptocurrencies dropping to less than 20%. This pullback has cleared excess leverage from the market, potentially signaling a cooling period in the coming weeks. The correction forced the closure of $1 billion worth of leveraged perpetual futures bets across digital asset markets, and the market could continue to deleverage, potentially pushing bitcoin's price back to $40,000, according to one observer.

- Crypto Funding Rates Reset After Bitcoin's Sharp Pullback From $69K CoinDesk

- Bitcoin hits new all-time high near $69,000 before tumbling Yahoo Finance

- Bitcoin's Stunning Climb to New Records - WSJ The Wall Street Journal

- BTC price dips after all-time high. Where is it headed next? Blockworks

- Why Gold and Bitcoin Are Gaining—and Why the Rallies Won’t Last Barron's

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

2 min

vs 3 min read

Condensed

79%

445 → 92 words

Want the full story? Read the original article

Read on CoinDesk