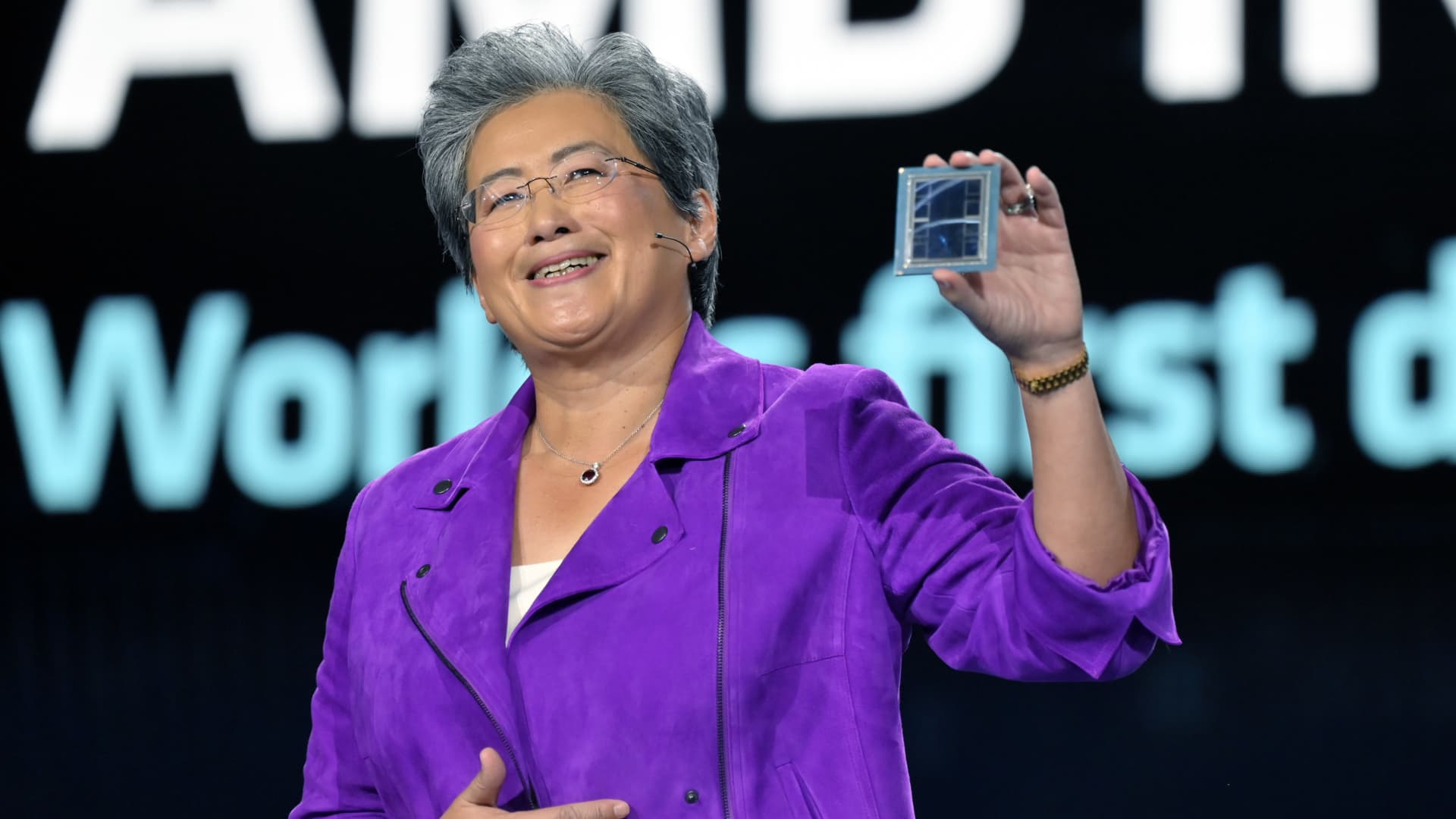

"Analysts Divided Over AMD's AI Potential Amid Stock Surge"

TL;DR Summary

AMD's stock has surged nearly 130% in 2023 due to high demand for its AI-oriented GPUs, leading to uncertainty among analysts about its future trajectory. Northland Capital Markets analyst Gus Richard downgraded the stock to a "heck if we know" rating, citing irrational exuberance and distorted demand signals in the AI chip market. He predicts total AI chip revenue of $125 billion in 2027, but believes that investor expectations are overly optimistic. Despite the surge, AMD shares fell about 3.5% to $168.17 as of Monday afternoon.

- AMD's stock surge in past year leads analyst to a 'heck if we know' rating CNBC

- AMD (NASDAQ:AMD) AI Hype Sparks Downgrade - TipRanks.com TipRanks

- AMD cut at Northland as AI 'not as big as investors are thinking' By Investing.com Investing.com

- AMD's AI narrative overshadowed last years' misses, says Bernstein's Stacy Rasgon CNBC

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

1 min

vs 2 min read

Condensed

77%

381 → 86 words

Want the full story? Read the original article

Read on CNBC