"FedEx's Strategic Cost Reductions Propel Earnings, Shares Soar"

TL;DR Summary

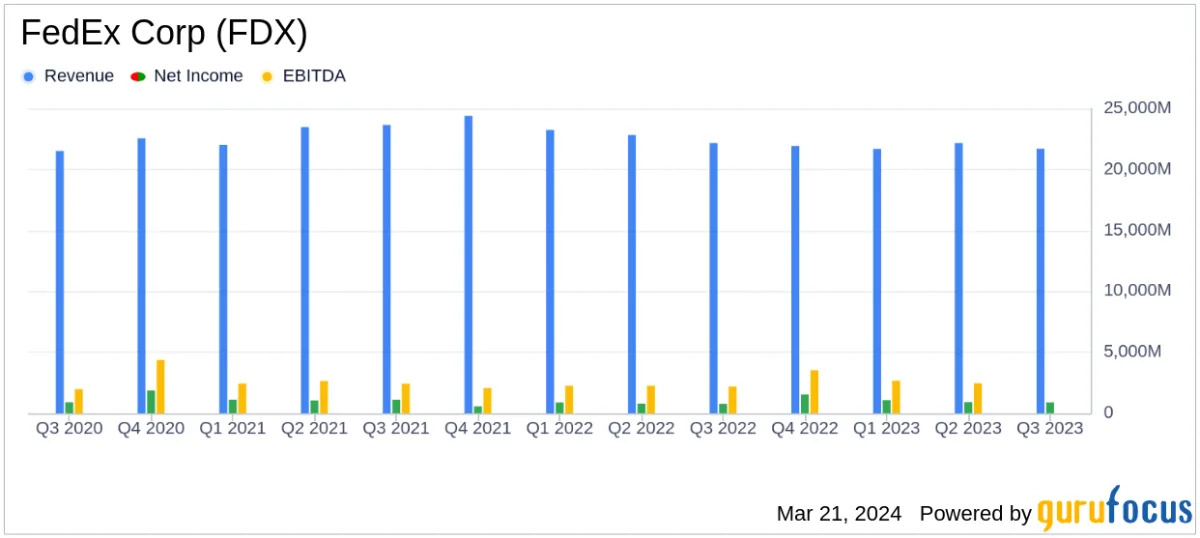

FedEx Corp (NYSE: FDX) exceeded earnings expectations for the third quarter, reporting a revenue of $21.7 billion and a net income of $879 million. The company's strategic cost reduction initiatives, particularly the DRIVE program, contributed to a 19% increase in operating income. Additionally, FedEx announced a $500 million share repurchase in Q4 and a new $5 billion repurchase program, while narrowing its full-year earnings outlook. Despite challenges in certain segments, the company remains committed to long-term growth and shareholder returns through ongoing transformation efforts and network optimization.

Topics:business#businessfinance#cost-reduction#earnings#fedex#share-repurchase#strategic-initiatives

- FedEx Corp (FDX) Surpasses Earnings Expectations with Strategic Cost Reductions and Share ... Yahoo Finance

- FedEx tightens 2024 profit forecast on cost cuts, shares jump 13% Yahoo Finance

- FedEx’s stock jumps 10% after logistics company raises guidance, trims spending MarketWatch

- FDX Earnings: FedEx Jumps 10% on Q3 Earnings Beat - TipRanks.com TipRanks

- FedEx Plans $5 Billion Buyback as CEO’s Overhaul Takes Hold Bloomberg

Reading Insights

Total Reads

0

Unique Readers

9

Time Saved

2 min

vs 3 min read

Condensed

80%

427 → 87 words

Want the full story? Read the original article

Read on Yahoo Finance