"WeWork Emerges from Bankruptcy with New Leadership and Reduced Debt"

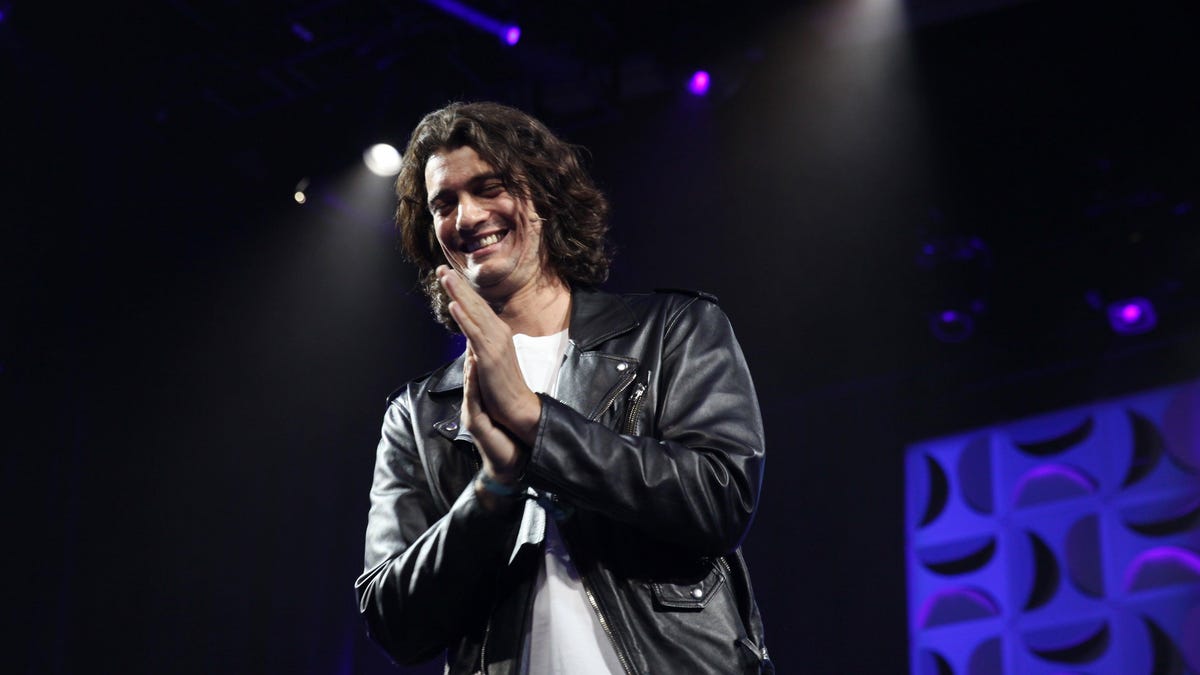

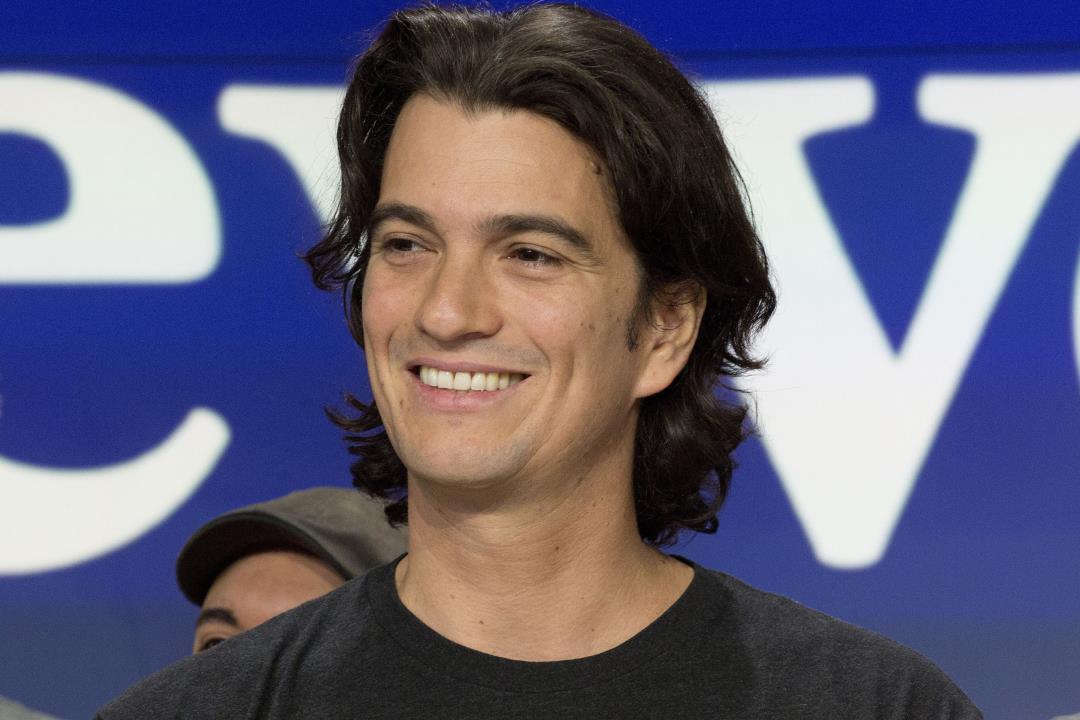

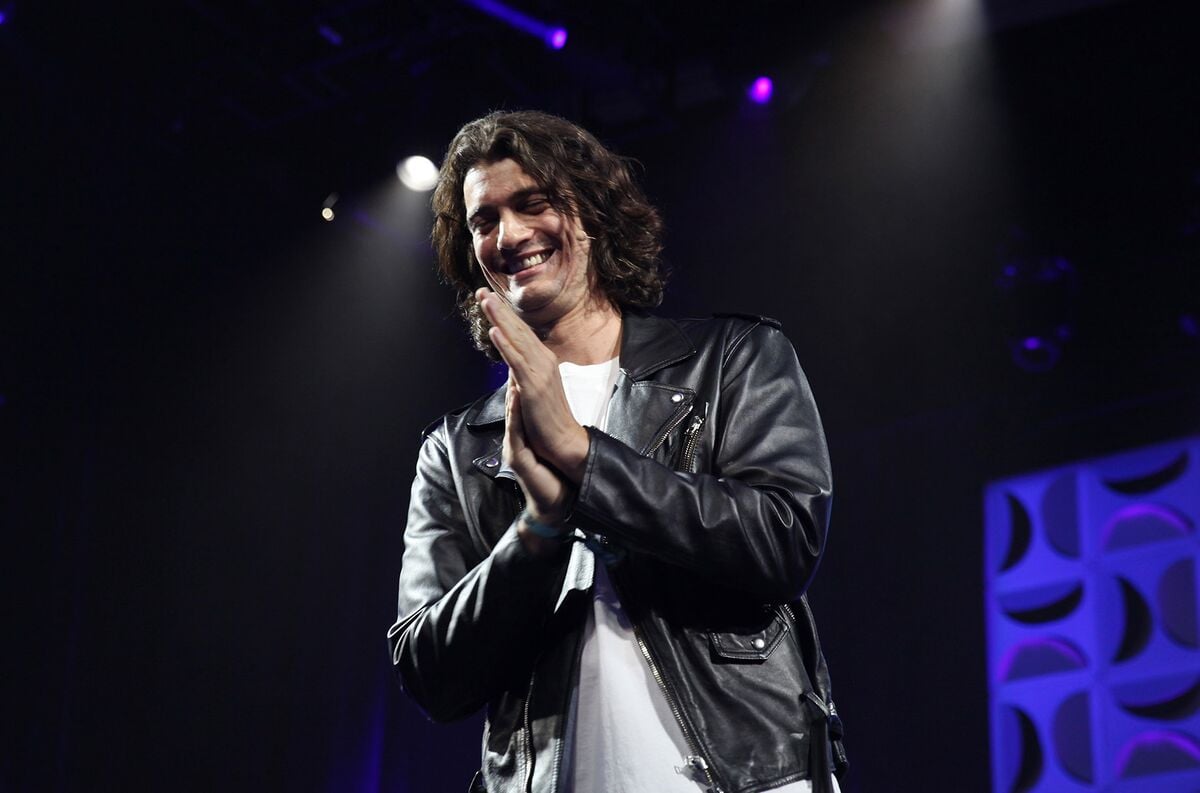

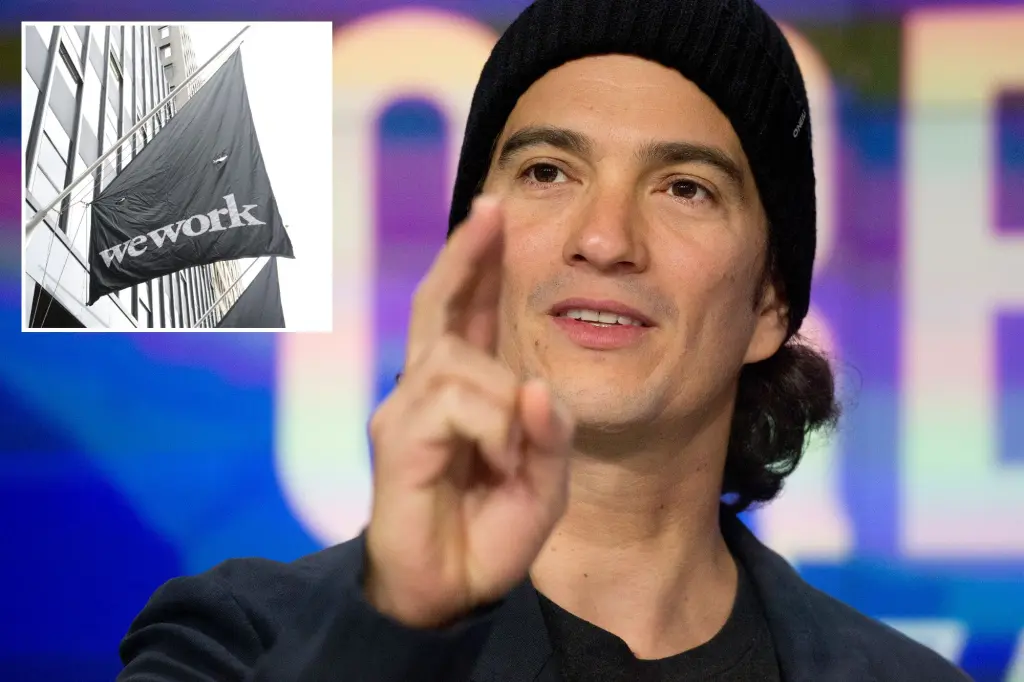

Anant Yardi, a software tycoon, will take control of WeWork following a federal bankruptcy court's decision. Yardi, who has invested significantly in WeWork, aims to revitalize the company by targeting small businesses and incorporating new technologies. This transition comes after former CEO Adam Neumann's failed attempt to regain control of the company.