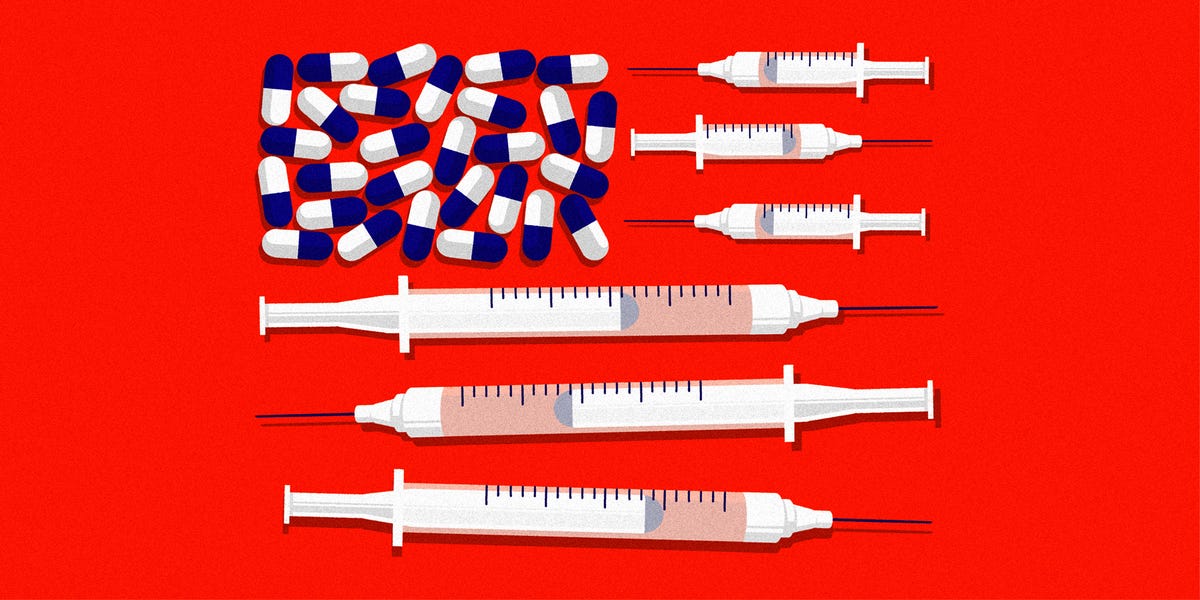

"Uncovering Big Pharma's Tax Evasion Tactics"

Major US pharmaceutical companies are using legal loopholes to shift their profits from US sales to low-tax jurisdictions, allowing them to avoid paying billions in US taxes. Despite Americans paying the highest prices for medicines, these companies report minimal profits in the US while earning significant profits abroad. The offshore profit shifting is enabled by the US corporate tax code, which incentivizes the relocation of intellectual property and manufacturing to low-tax countries. The 2017 Trump corporate tax reform further exacerbated the problem. To address this issue, common-sense reforms such as implementing a minimum tax on overseas profits and limiting tax credits for research on drugs developed outside the US could help recapture tax revenues, promote domestic investment, and foster innovation in the US pharmaceutical industry.