Oil and Gas Mergers Spark Bull Market as Chevron Acquires Hess in $53 Billion Deal

TL;DR Summary

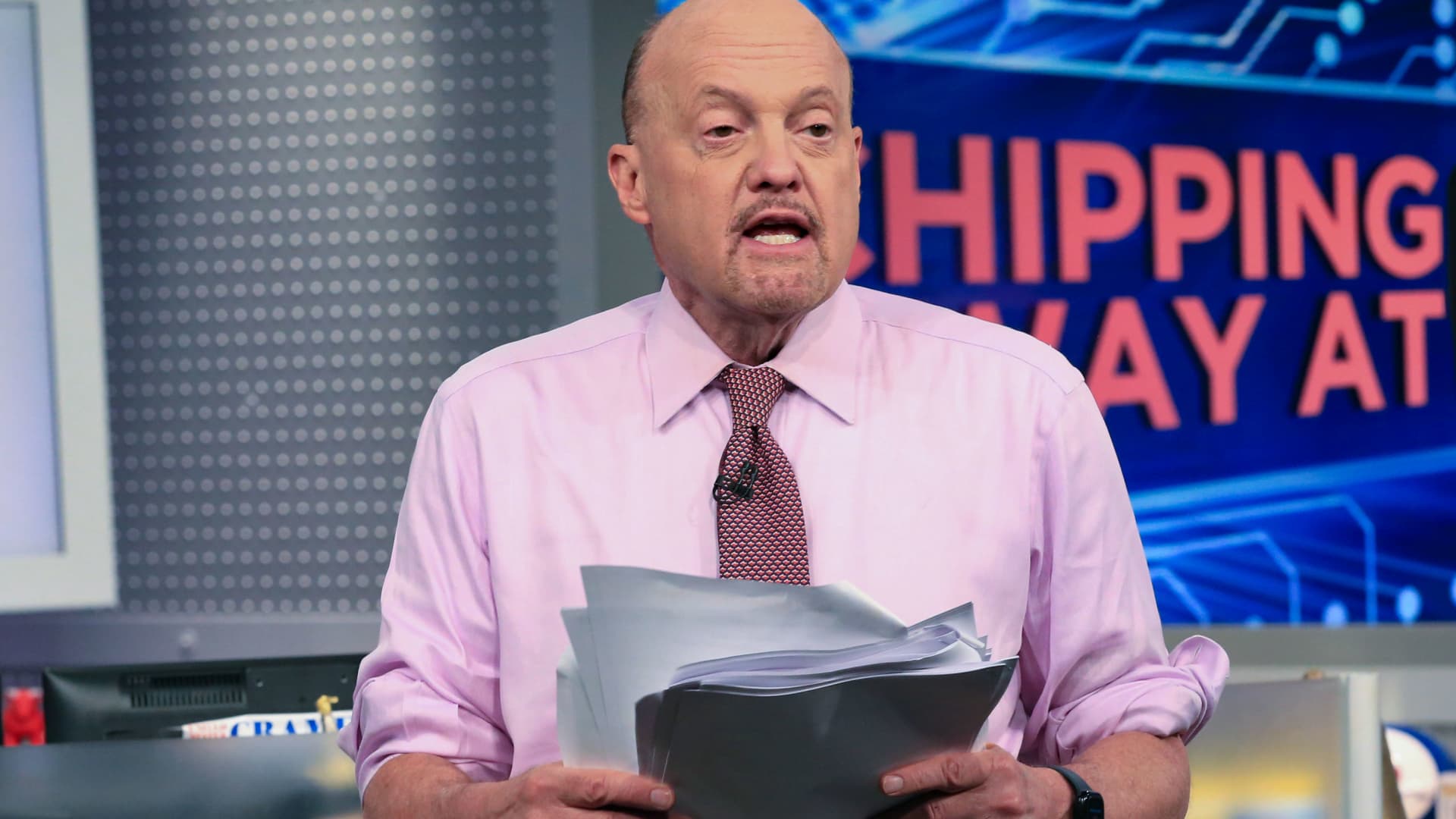

CNBC's Jim Cramer believes there is a bull market in the oil and gas sector, attributing it to recent major mergers and the rising price of crude. Cramer highlighted Chevron's acquisition of Hess and Exxon Mobil's purchase of Pioneer Natural Resources as significant deals. He compared the current trend to oil takeovers in the 1980s and emphasized the potential for increased earnings through strategic deals. Cramer noted that Wall Street is slow to recognize this trend due to concerns about ESG and electric vehicle sales, but he encouraged investors to stay invested in oil stocks.

- Jim Cramer says there is a bull market in oil and gas thanks to recent big mergers CNBC

- Chevron to acquire Hess in $53 billion deal Fox Business

- Nasdaq 100, Dow Jones, S&P 500 News: Chevron’s $53B Deal, Hawkish Fed, and Earnings Fireworks Ahead FX Empire

- Chevron Buys Hess for $53 Billion as Oil Mega-Deals Are Back Bloomberg

- Businesses push for clarity on fossil fuel phaseout Financial Times

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

1 min

vs 2 min read

Condensed

67%

292 → 95 words

Want the full story? Read the original article

Read on CNBC