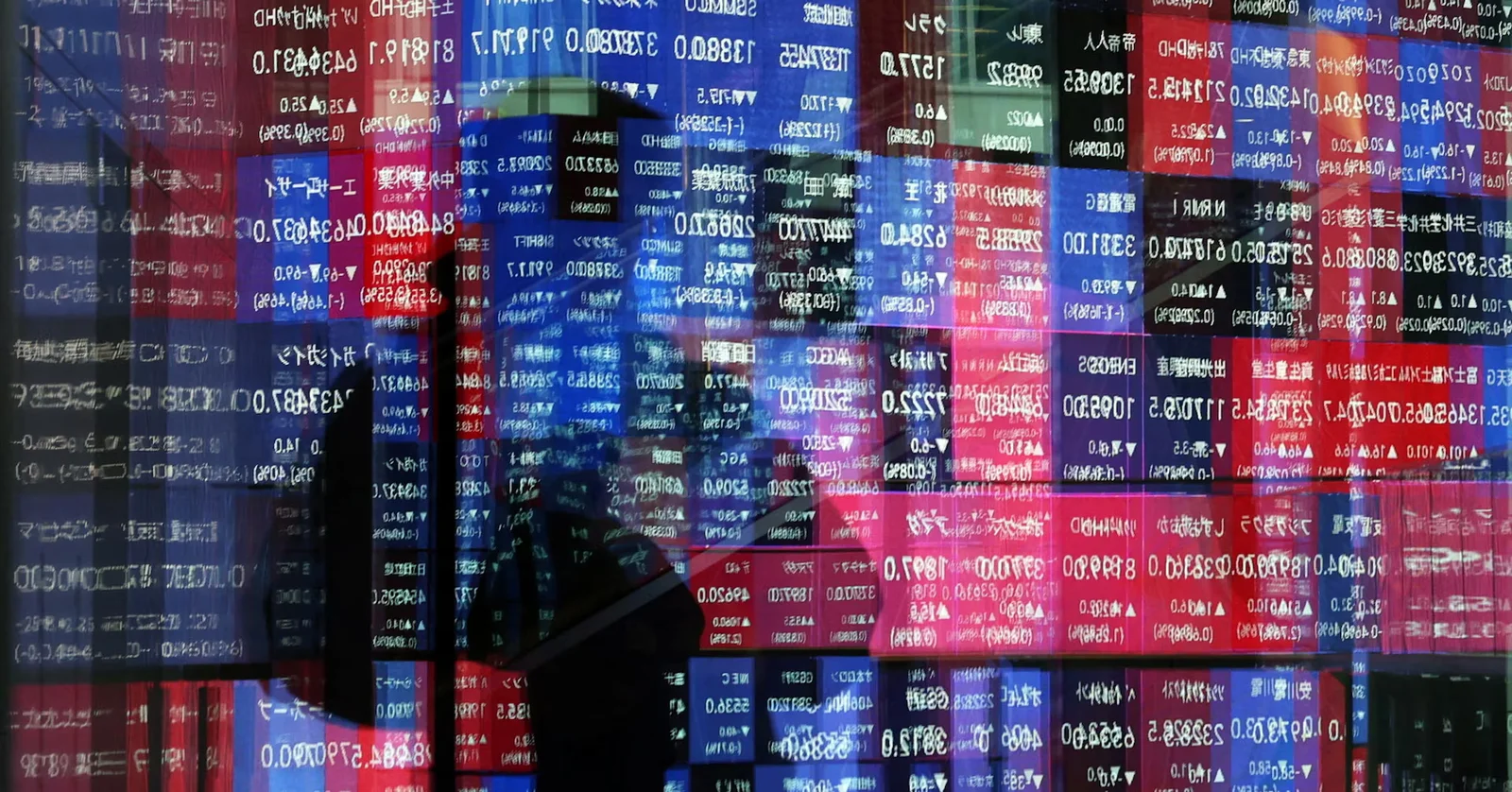

Tax-relief jitters keep Japan markets on edge, ex-diplomat warns

TL;DR Summary

Japan’s markets remain jittery over potential fiscal loosening, with a former currency diplomat warning that additional tax relief could spark a renewed selloff in government bonds and a weaker yen. Investors are wary of LDP signals ahead of the February 8 snap election, and while the yen has rebounded to about 154 per dollar, analysts say a sustained recovery is unlikely and a brief move into the 140s per dollar remains possible if policy expectations shift.

- Japan markets on edge over looser fiscal policy, ex-currency diplomat Watanabe says Reuters

- Japanese Bond Selloff: We See Risk of Future Fiscal Constraint but Limited Impact on Equities Morningstar

- Japan’s aging crisis shows how dementia threatens economies and household wealth. The US is not immune Yahoo Finance

- The fate of Japan’s $6trn foreign portfolio rattles global markets The Economist

- This 'mutually assured destruction' threat helps prevent Japan from triggering a debt crisis for now Fortune

Reading Insights

Total Reads

0

Unique Readers

4

Time Saved

30 min

vs 31 min read

Condensed

99%

6,143 → 76 words

Want the full story? Read the original article

Read on Reuters